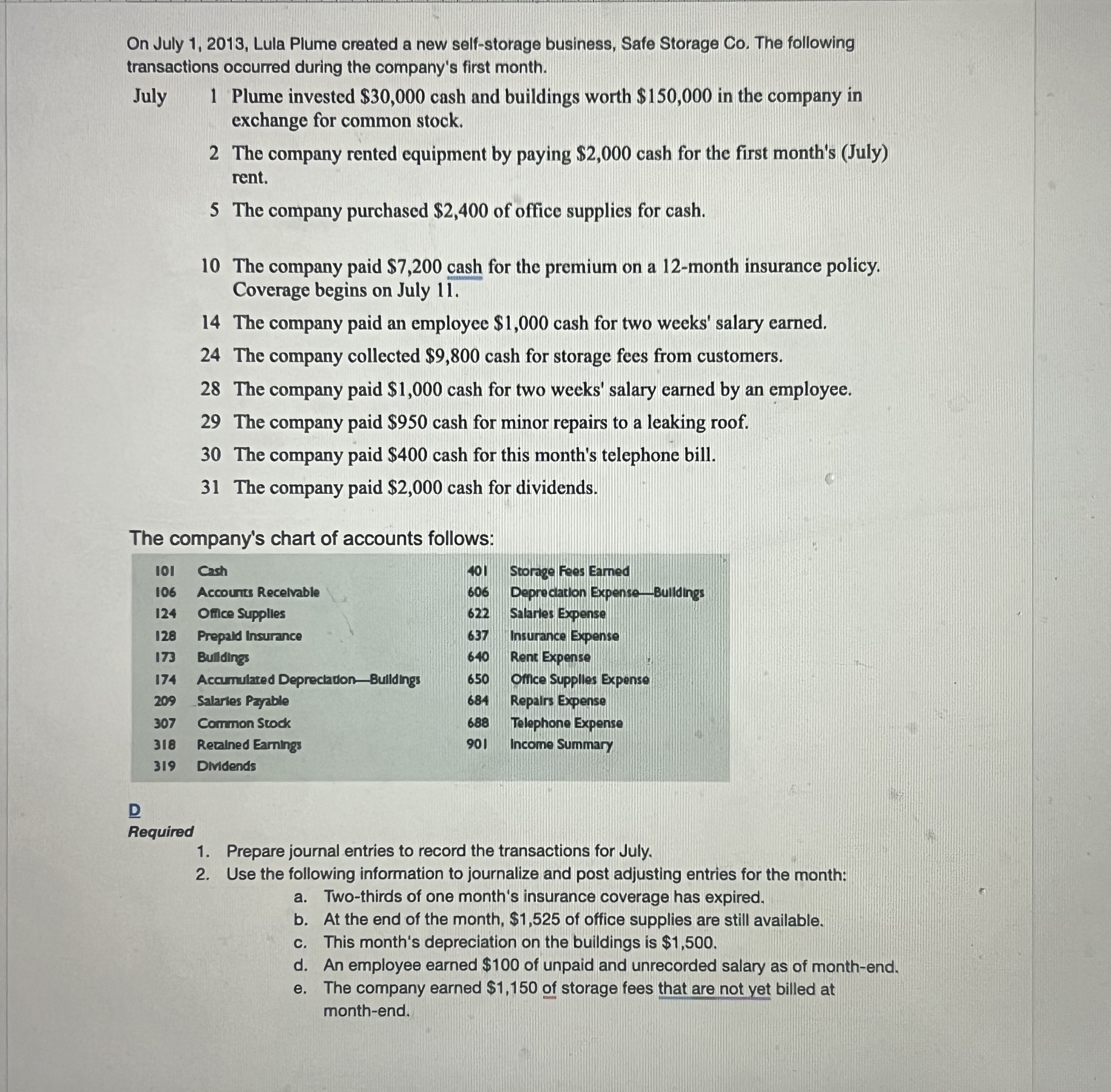

Question: On July 1 , 2 0 1 3 , Lula Plume created a new self - storage business, Safe Storage Co . The following transactions

On July Lula Plume created a new selfstorage business, Safe Storage Co The following

transactions occurred during the company's first month.

July Plume invested $ cash and buildings worth $ in the company in

exchange for common stock.

The company rented equipment by paying $ cash for the first month's July

rent.

The company purchased $ of office supplies for cash.

The company paid $ cash for the premium on a month insurance policy.

Coverage begins on July

The company paid an employee $ cash for two weeks' salary earned.

The company collected $ cash for storage fees from customers.

The company paid $ cash for two weeks' salary earned by an employee.

The company paid $ cash for minor repairs to a leaking roof.

The company paid $ cash for this month's telephone bill.

The company paid $ cash for dividends.

The company's chart of accounts follows:

D

Required

Prepare journal entries to record the transactions for July.

Use the following information to journalize and post adjusting entries for the month:

a Twothirds of one month's insurance coverage has expired.

b At the end of the month, $ of office supplies are still available.

c This month's depreciation on the buildings is $

d An employee earned $ of unpaid and unrecorded salary as of monthend.

e The company earned $ of storage fees that are not yet billed at

monthend.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock