Question: On July 1 , 2 0 2 2 , the fair value of the plant and equipment was $ 6 3 0 , 0 0

On July the fair value of the plant and equipment was $ more than its carrying amount,

The acquisitiondate fair values approximated their recorded book values for all of goodwill must the investor

vidual net assets of the investee. Related to this transaction, what

report in its postacquisition consolidated balance shec $

a $

d $

b $

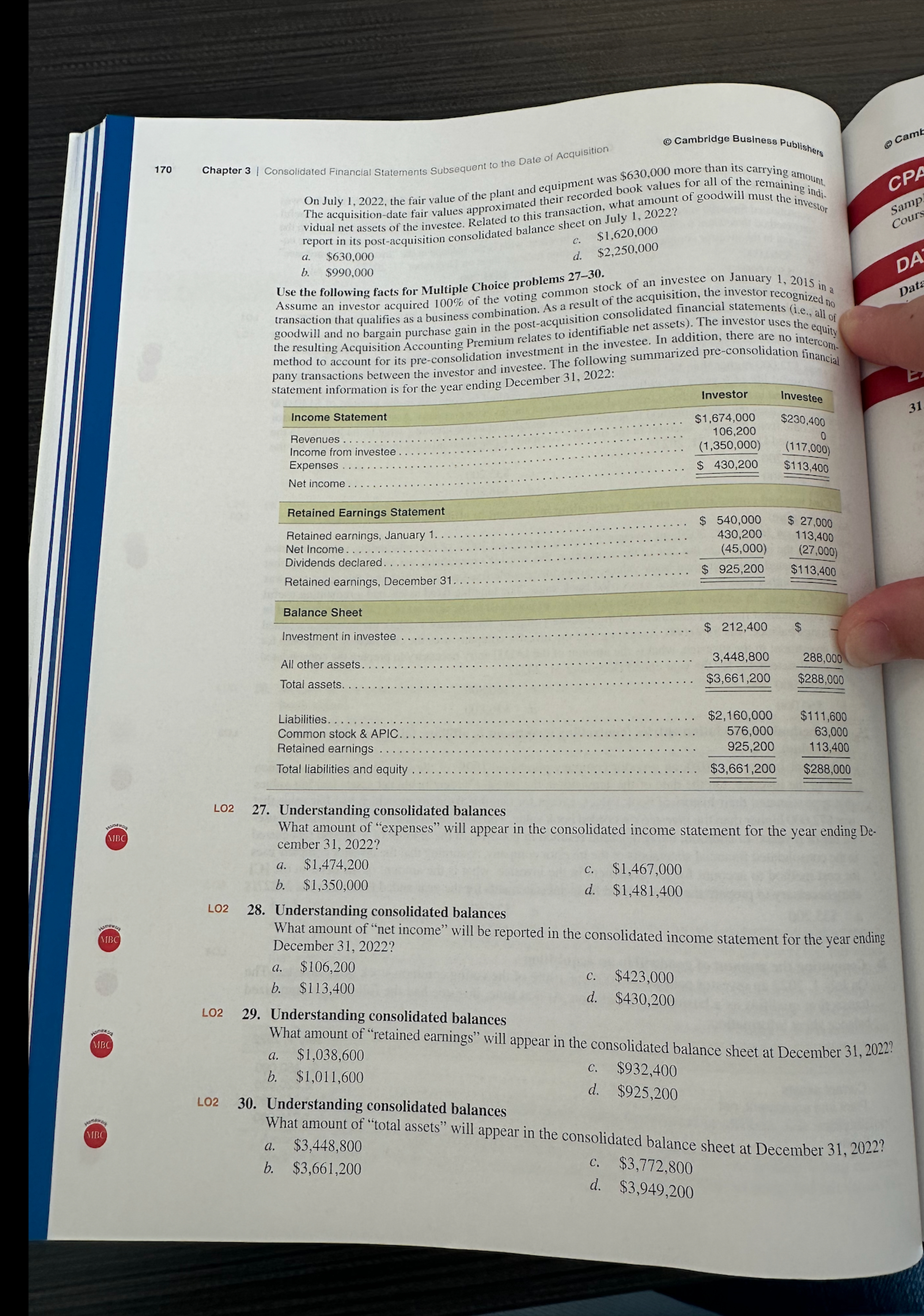

Use the following facts for Multiple Choice problems

Assume an investor acquired of the voting common stock of an investee on January in a

transaction that qualifies as a business combination. As a result of the acquisition, the investor recognized no

the resulting Acquisition Accounting Premium relates to identesterestion. In addition, there are no intercom.

method to account for its preconsolidation investm. The following summarized preconsolidation financial

pany transactions between the investor and ing December :

statement information is for the year ending Decenber :

LO

LO

LO

Understanding consolidated balances

What amount of "retained earnings" will appear in the consolidated balance sheet at December

a $

b $

c $

d $

LO

Understanding consolidated balances

What amount of "total assets" will appear in the consolidated balance sheet at December

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock