Question: On July 1 , 2 0 2 3 , Crane Company purchased factory equipment for $ 1 , 0 3 6 , 2 0 0

On July Crane Company purchased factory equipment for $ with an estimated $ salvage value. The estimated useful life for the equipment is years. During and the equipment is depreciated using the straightline method. During $ in maintenance is required on the machine to keep it running up to its standard operating specifications. Also, in $ is spent to improve the equipment's efficiency and prolong its useful life. The new useful life is expected to be an additional years beginning in and the revised salvage value is $

a

Your answer has been saved. See score details after the due date.

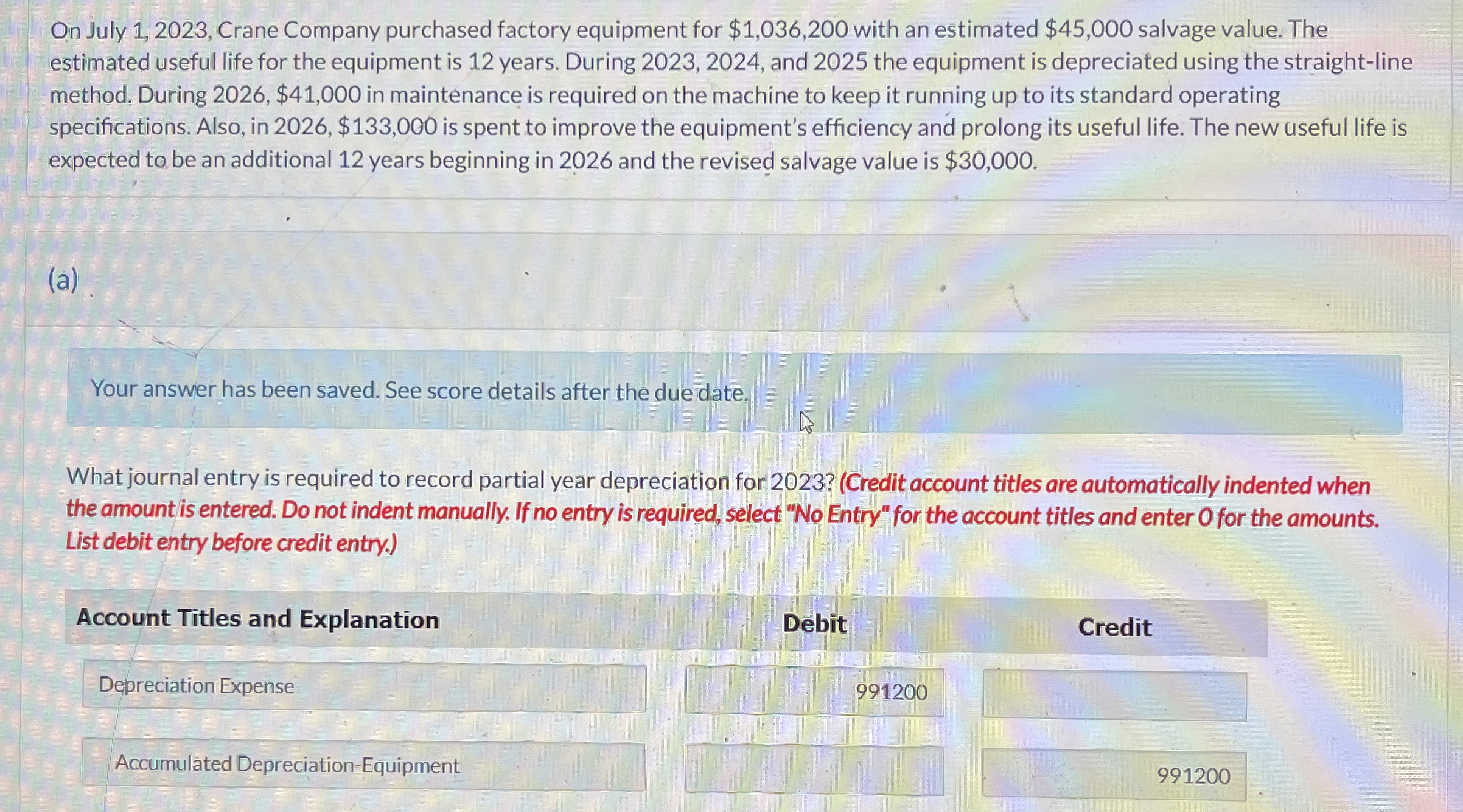

What journal entry is required to record partial year depreciation for Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List debit entry before credit entry.

Account Titles and Explanation

tableDepreciation Expense,Debit,CreditAccumulated DepreciationEquipment,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock