Question: On July 1 , 2 0 2 3 , Pharoah Ltd . received a loan from its bank for 1 5 , 0 0 0

On July Pharoah Ltd received a loan from its bank for bearing interest at The loan is payable in two annual ninstalments of principal and interest on June each year. The company records adjusting journal entries annually at year end non December na nPrepare an instalment payment schedule for the term of the loan. Round answers to decimal places, eg nAnnual nInterest nPeriod nCash Payment nInterest Expense nReduction of Principal nPrincipal Bal nJuly n nJune n n nJune n n On July Pharoah Ltd received a loan from its bank for $ bearing interest at On October Sandhill Corporation issuad $ of year, bonds at Intarest is payable samiannually on October

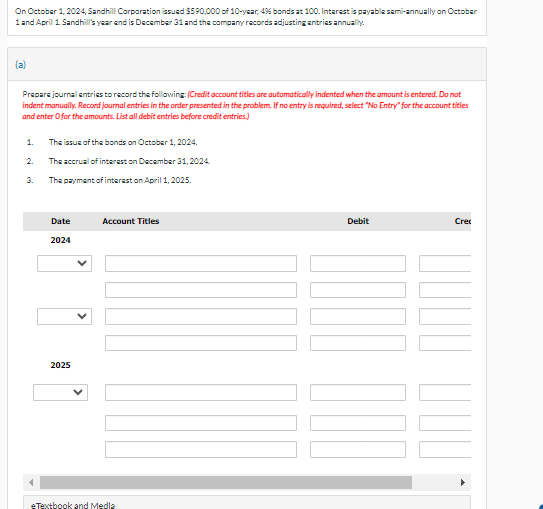

and April Sandhill's year end is December and the compary records adjusting antrias annually.

a

Prapare journal antriss to record the following: Credit account titles are automatically indented when the amount is entered. Do not

indent manually. Record journal entries in the order presented in the problem. If no entry is required, select No Entry" for the account titles

and enter for the amounts. List all debit entries before credit entries.

The issua of the bonds on October

The accrual of interast on December

The payment of interast on April

a Teutbogk and Medla

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock