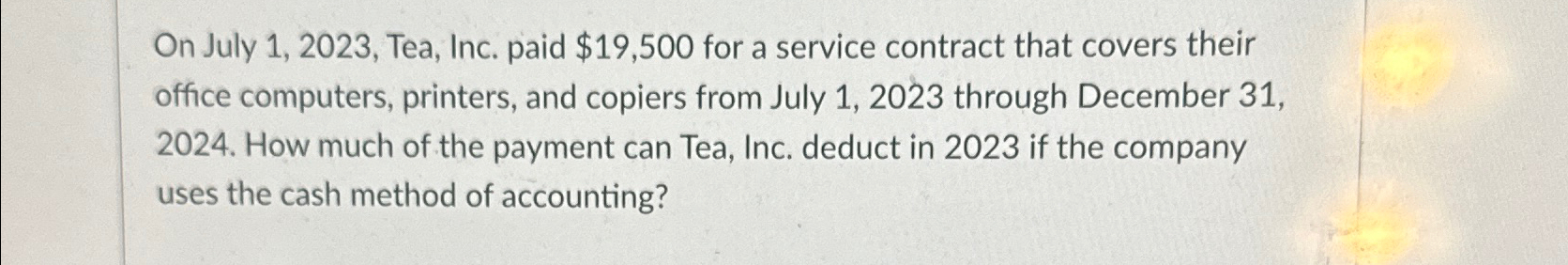

Question: On July 1 , 2 0 2 3 , Tea, Inc. paid $ 1 9 , 5 0 0 for a service contract that covers

On July Tea, Inc. paid $ for a service contract that covers their office computers, printers, and copiers from July through December How much of the payment can Tea, Inc. deduct in if the company uses the cash method of accounting?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock