Question: On July 1 , 2 0 2 4 , Travis Company acquired a 7 0 percent interest in Beaver Company in exchange for consideration of

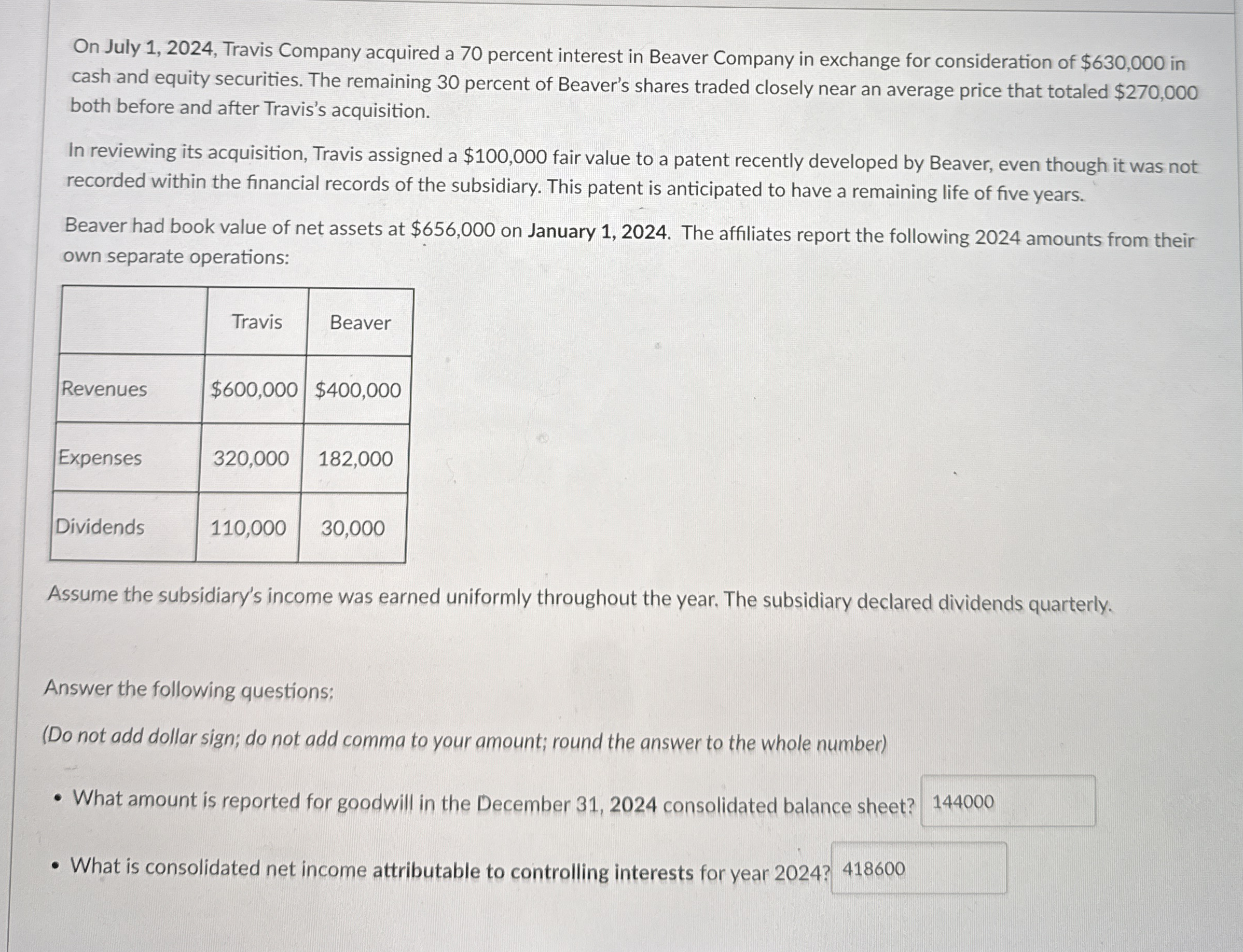

On July Travis Company acquired a percent interest in Beaver Company in exchange for consideration of $ in cash and equity securities The remaining percent of Beaver's shares traded closely near an average price that totaled $ both before and after Travis's acquisition.

In reviewing its acquisition, Travis assigned a $ fair value to a patent recently developed by Beaver, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years.

Beaver had book value of net assets at $ on January The affiliates report the following amounts from their own separate operations:

tableTravis,BeaverRevenues$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock