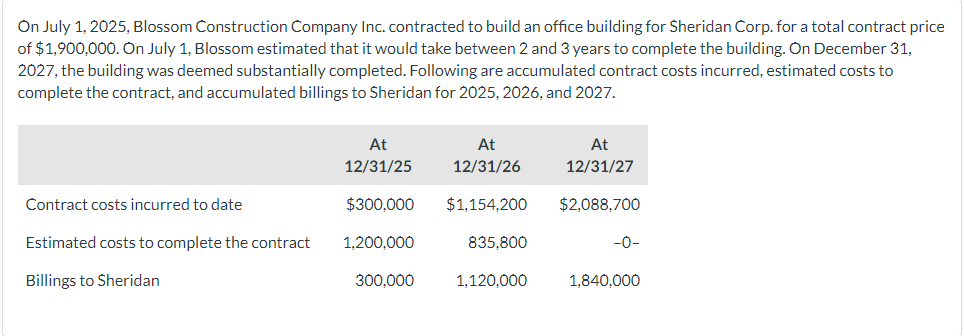

Question: On July 1 , 2 0 2 5 , Blossom Construction Company Inc. contracted to build an office building for Sheridan Corp. for a total

On July Blossom Construction Company Inc. contracted to build an office building for Sheridan Corp. for a total contract price Your answer is incorrect.

Using the costrecovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for

the years ended December Ignore income taxes.If answer is please enter Do not leave any fields blank.

$

eTextbook and Media

Attempts: of used

b

Using the costrecovery method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for

the years ended December Ignore income taxes.If answer is please enter Do not leave any fields blank.

$

$ Using the costrecovery method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for

the years ended December Ignore income taxes.If answer is please enter O Do not leave any fields blank.

$

:

of $ On July Blossom estimated that it would take between and years to complete the building. On December

the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to

complete the contract, and accumulated billings to Sheridan for and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock