Question: On July 1 , 2 0 2 5 , Bridgeport Company purchased for $ 7 , 0 2 0 , 0 0 0 snow

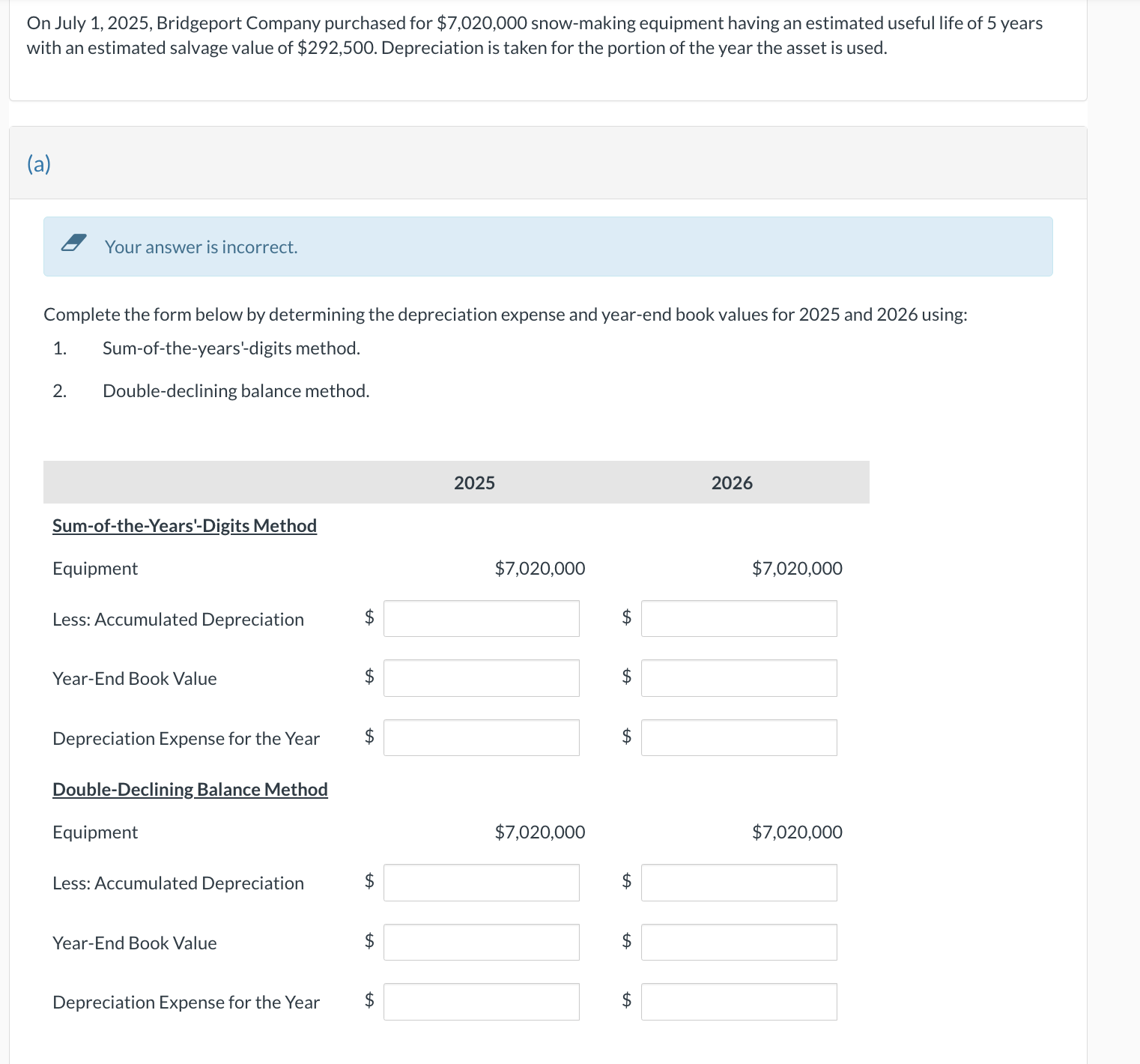

On July Bridgeport Company purchased for $ snowmaking equipment having an estimated useful life of years with an estimated salvage value of $ Depreciation is taken for the portion of the year the asset is used.

a

Your answer is incorrect.

Complete the form below by determining the depreciation expense and yearend book values for and using:

Sumoftheyears'digits method.

Doubledeclining balance method.

SumoftheYears'Digits Method

Equipment

$

$

Less: Accumulated Depreciation

$

$

$

YearEnd Book Value

Depreciation Expense for the Year

$

$

DoubleDeclining Balance Method

Equipment

$

$

Less: Accumulated Depreciation

YearEnd Book Value

$

$

$

$

$

Depreciation Expense for the Year

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock