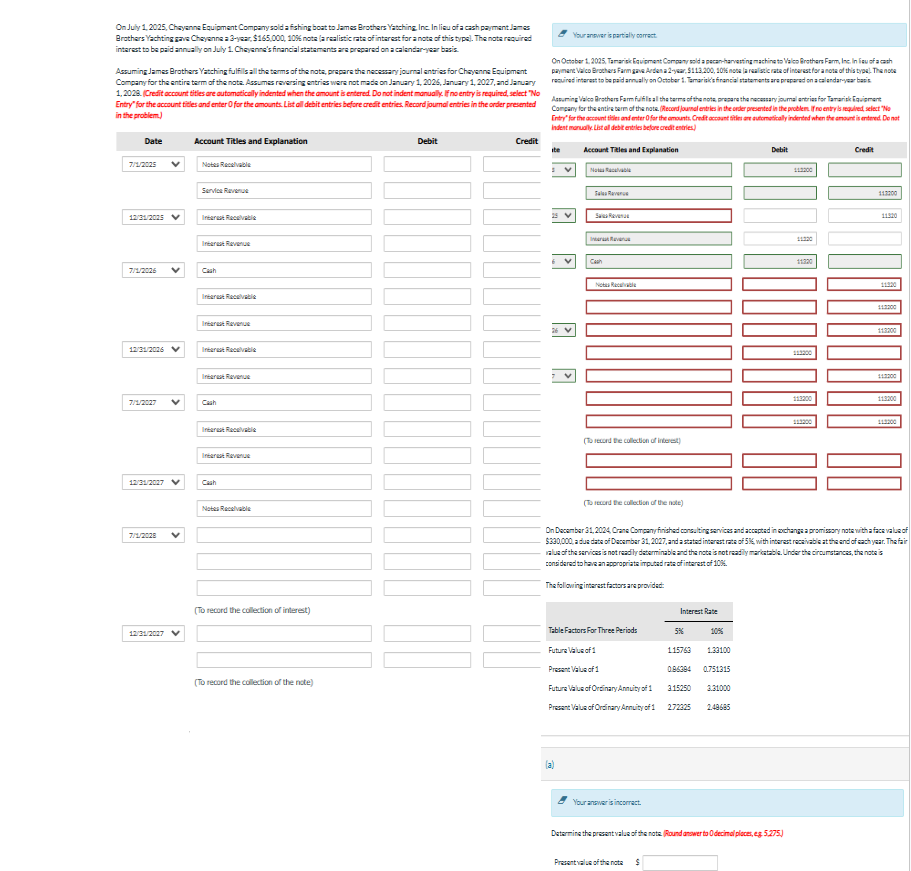

Question: On July 1 , 2 0 2 5 , Cheyenne Equipment Company sold a fishing boat to James Brothers Yatching, Inc. In lieu of a

On July Cheyenne Equipment Company sold a fishing boat to James Brothers Yatching, Inc. In lieu of a cash payment James

Brothers Yachting gave Cheyenne a year, $ nota la realistic rate of interest for a note of this type The note required

interest to be paid annually on July Cheyenne's financial statements are prepared on a calendaryear basis.

Assuming James Brothers Yatching fulfills all the terms of the note, prepare the necessary journal entries for Cheyenne Equipment

Company for the entire term of the note. Assumes reversing entries were not made on January January and January

Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No

Entry" for the account titles and enter for the amounts. List all debit entries before credit entries. Record journal entries in the order presented

in the problem.

Your answer is partially correct

On October Tamarisk Equipment Company sold a pecanharvesting machine to Valco Brothers Farm, Inc. In lieu of a cash

payment Valco Brothers Farm gave Arden a year, $ note a realistic rate of interest for a note of this type The note

required interest to be paid annually on October Tamarisk's financial statements are prepared on a calendaryear basis

Assuming Valco Brothers Farmfulfills all the terms of the note, prepare the necessary journal entries for Tamarisk Equipment

Company for the entire term of the note. Record journal entries in the order presented in the problem. If no entry is required, select No

Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not

indent manually. List all debit entries before credit entries

Date

Account Titles and Explanation

Notes Receivable

Service Revenue

Interest Receivable

Interest Revenue

Cash

Interest Receivable

Interest Revenue

V

Interest Receivable

Interest Revenue

Cash

Interest Receivable

Interest Revenue

Cash

Notes Receivable

Debit

Credit

ite

Account Titles and Explanation

Notes Recevabl

Debit

TalesRun

SR

Intera Revenue

Cash

Notes Receivable

To record the collection of interest

To record the collection of the note

Credit

On December Crane Company finished consulting services and accepted in exchange a promissory note with a face value of

$ a due date of December and a stated interest rate of with interest receivable at the end of each year. The fair

value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is

considered to have an appropriate imputed rate of interest of

The following interest factors are provided:

To record the collection of interest

V

Interest Rate

Table Factors For Three Periods

Future Value of

Present Value of

To record the collection of the note

Future Value of Ordinary Annuity of

Present Value of Ordinary Annuity of

a

Your answer is incorrect.

Determine the present value of the note Round answer to decimal places, eg

Present value of the nota $

This is one big question, pictures are attached for the full problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock