Question: On July 1 , 2 0 2 6 , Tanner - UNF Corporation acquired as a long - term investment $ 2 5 0 .

On July TannerUNF Corporation acquired as a longterm investment $ million of bonds, dated July Company

management has the positive intent and ability to hold the bonds until maturity. TannerUNF paid $ million for the bonds. The

company will receive interest semiannually on June and December As a result of changing market conditions, the fair value of

the bonds at December was $ million.

Required:

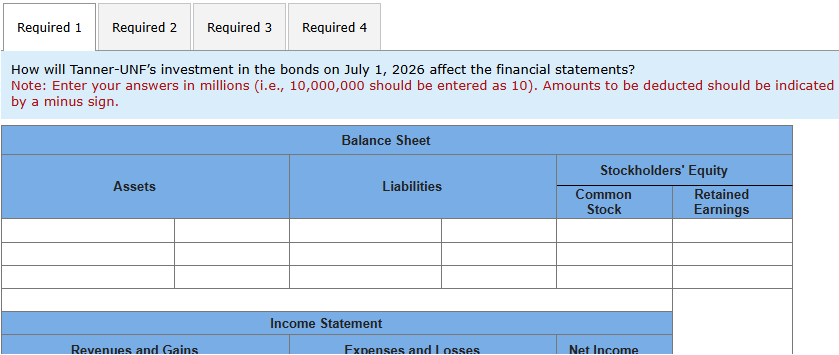

How will TannerUNF's investment in the bonds on July affect the financial statements?

How will TannerUNF's receipt of interest on December affect the financial statements?

At what amount will TannerUNF report its investment in the December balance sheet?

Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating TannerUNF to sell the investment on

January for $ million. How will the sale of the bond investment affect TannerUNF's financial statements? How will TannerUNF's investment in the bonds on July affect the financial statements?

Note: Enter your answers in millions ie should be entered as Amounts to be deducted should be indicated

by a minus sign. How will TannerUNF's receipt of interest on December affect the financial statements?

Note: Enter your answers in millions rounded to decimal place, ie should be entered as Amounts to be

deducted should be indicated by a minus sign. Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

At what amount will TannerUNF report its investment in the December balance sheet?

Note: Enter your answer in millions, ie should be entered as

tableInvestment$times million Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating TannerUNF to sell the investment

on January for $ million. How will the sale of the bond investment affect TannerUNF's financial statements?

Note: Enter your answers in millions, ie should be entered as Amounts to be deducted should be indicated

by a minus sign.

Show less

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock