Question: On July 3 1 , 2 0 X 1 , after one month of operation, the general ledger of Carolina Consulting contained the following accounts

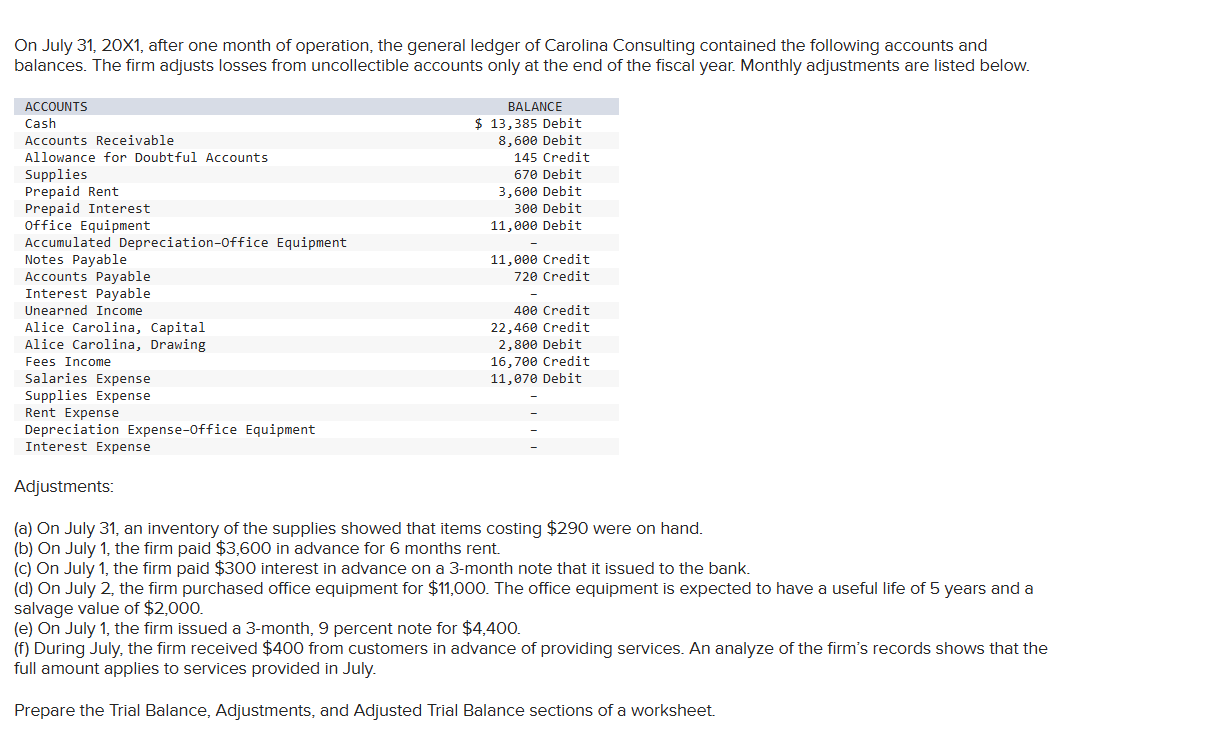

On July X after one month of operation, the general ledger of Carolina Consulting contained the following accounts and balances. The firm adjusts losses from uncollectible accounts only at the end of the fiscal year. Monthly adjustments are listed below. begintabularlr ACCOUNTS & BALANCE Cash & $ Debit Accounts Receivable & Debit Allowance for Doubtful Accounts & Credit Supplies & Debit Prepaid Rent & Debit Prepaid Interest & Debit Office Equipment & Debit Accumulated Depreciationffice Equipment & Notes Payable & Credit Accounts Payable & Credit Interest Payable & Unearned Income & Credit Alice Carolina, Capital & Credit Alice Carolina, Drawing & Debit Fees Income & Credit Salaries Expense & Debit Supplies Expense & Rent Expense & Depreciation ExpenseOffice Equipment & Interest Expense & endtabular Adjustments: a On July an inventory of the supplies showed that items costing $ were on hand. b On July the firm paid $ in advance for months rent. c On July the firm paid $ interest in advance on a month note that it issued to the bank. d On July the firm purchased office equipment for $ The office equipment is expected to have a useful life of years and a salvage value of $ e On July the firm issued a month, percent note for $ f During July, the firm received $ from customers in advance of providing services. An analyze of the firm's records shows that the full amount applies to services provided in July. Prepare the Trial Balance, Adjustments, and Adjusted Trial Balance sections of a worksheet. begintabularcccccccc

hline & & orksheet & & & & &

hline & Month Enc & ded July & & & & &

hline count Name & Trial Bal & ance & Adjustm & ents & & Adjustec Balan & Trial

Ice

hline & Debit & Credit & Debit & Credit & & Debit & Credit

hline Cash & $ & & & & & $ &

hline Accounts Receivable & times & & & & & &

hline Allowance for Doubiful Accounts & & & & & & &

hline Supplies & & & times & & & &

hline Prepaid Rent & & & x & & & &

hline Prepaid Interest & times & & times & & & &

hline Office Equipment & & & & & & &

hline Accumulated DepreciationOffice Equipment & & & times &

& & & sim

hline Notes Payable & & & H & & & & bigcirc

hline Accounts Payable & & sim & & & & &

hline Interest Payable & & & times & & & &

hline Unearned Income & & & & & & & times

hline Alice Carolina, Capital & & & & & & &

hline Alice Carolina, Drawing & & & & & & &

hline Fees Income & & & & & & &

hline Salaries Expense & & & & & & &

hline Supplies Expense & & & & & & &

hline Rent Expense & & & & & & &

hline Depreciation ExpenseOffice Equipment & & & & & & &

hline Interest ExpensePrepaid Interest Expired & & & & & & &

hline Interest ExpenseNotes Payable & & & & & & bigcirc &

hline Totals & $ & $ & $ & $ & & $ & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock