Question: On June 1 , 2 0 2 4 , Carla Vista Bottle Company sold $ 2 , 8 8 0 , 0 0 0 in

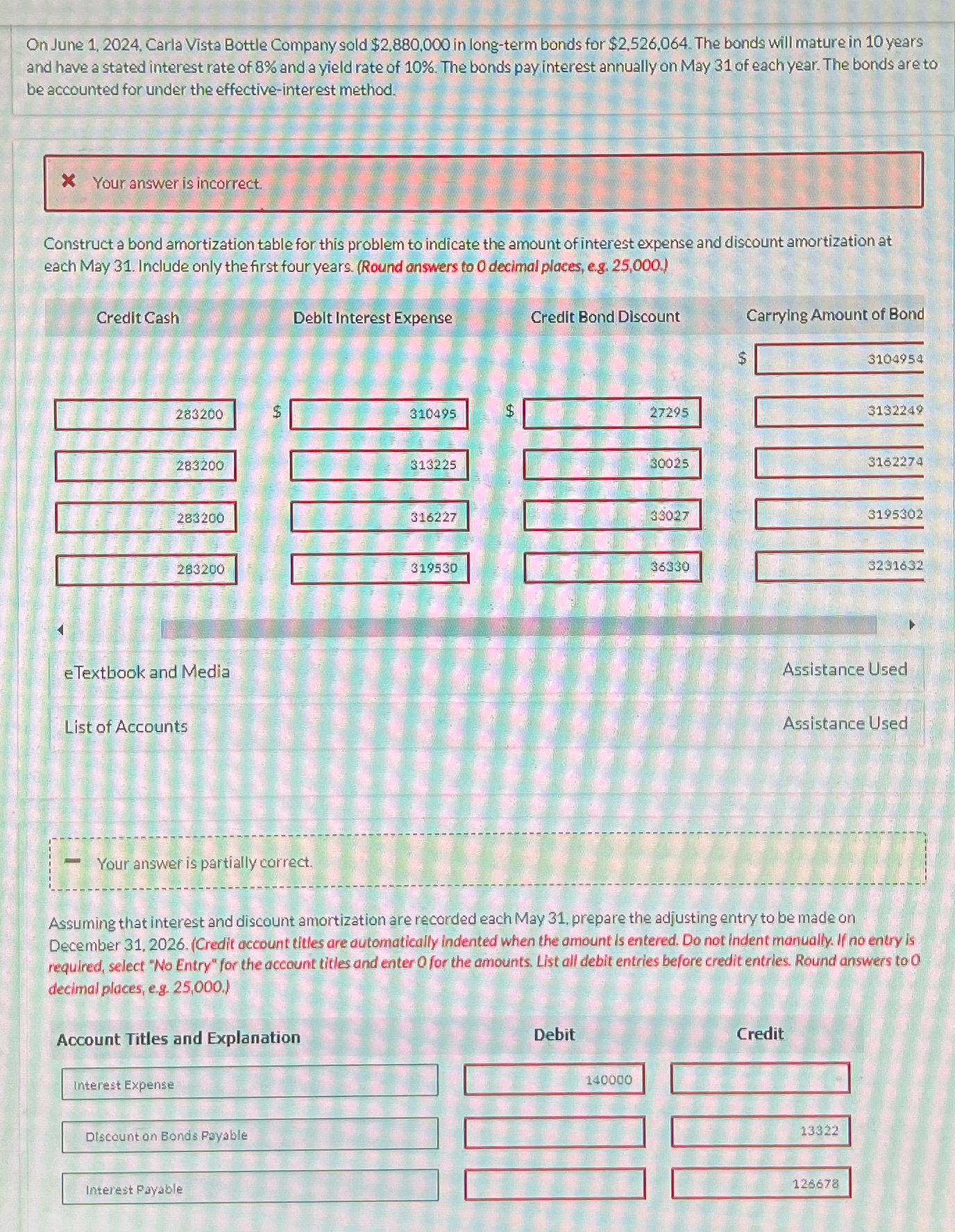

On June Carla Vista Bottle Company sold $ in longterm bonds for $ The bonds will mature in years and have a stated interest rate of and a yield rate of The bonds pay interest annually on May of each year. The bonds are to be accounted for under the effectiveinterest method.

Your answer is incorrect.

Construct a bond amortization table for this problem to indicate the amount of interest expense and discount amortization at each May Include only the first four years. Round answers to decimal places, e

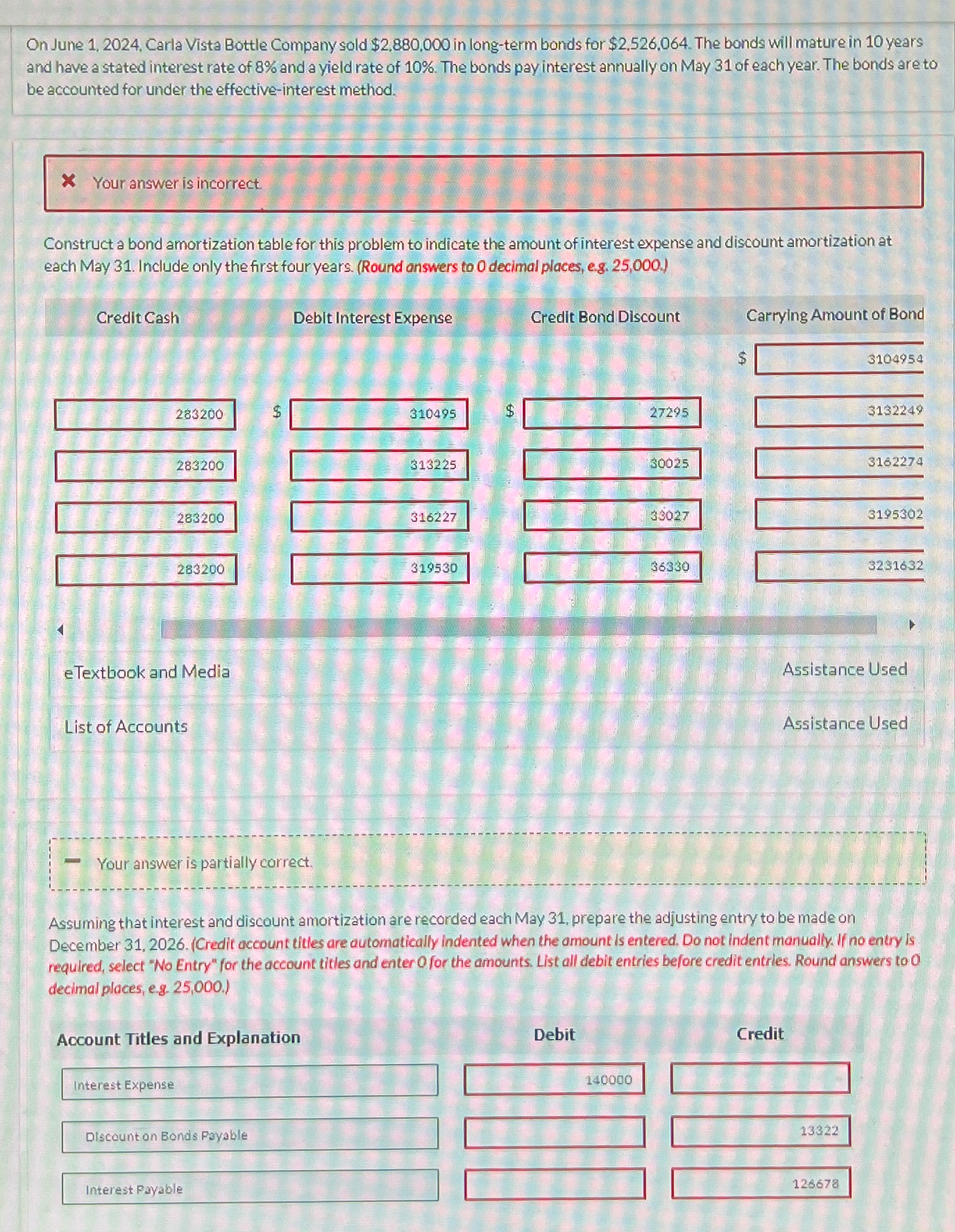

Assuming that interest and discount amortization are recorded each May prepare the adjusting entry to be made on December Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries. Round answers to decimal places, eg

Account Titles and Explanation

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock