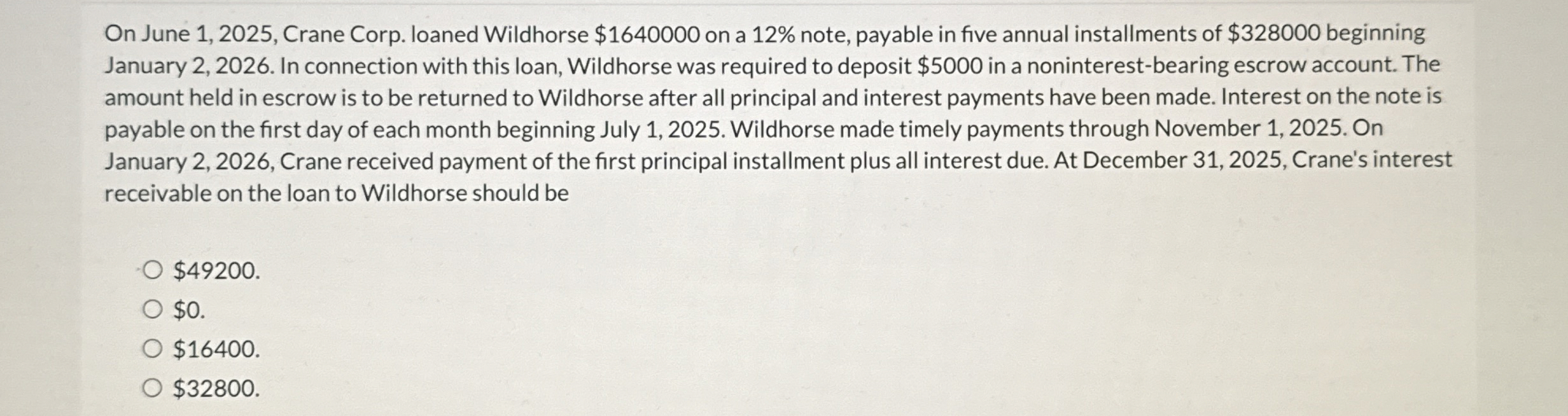

Question: On June 1 , 2 0 2 5 , Crane Corp. loaned Wildhorse $ 1 6 4 0 0 0 0 on a 1 2

On June Crane Corp. loaned Wildhorse $ on a note, payable in five annual installments of $ beginning

January In connection with this loan, Wildhorse was required to deposit $ in a noninterestbearing escrow account. The

amount held in escrow is to be returned to Wildhorse after all principal and interest payments have been made. Interest on the note is

payable on the first day of each month beginning July Wildhorse made timely payments through November On

January Crane received payment of the first principal installment plus all interest due. At December Crane's interest

receivable on the loan to Wildhorse should be

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock