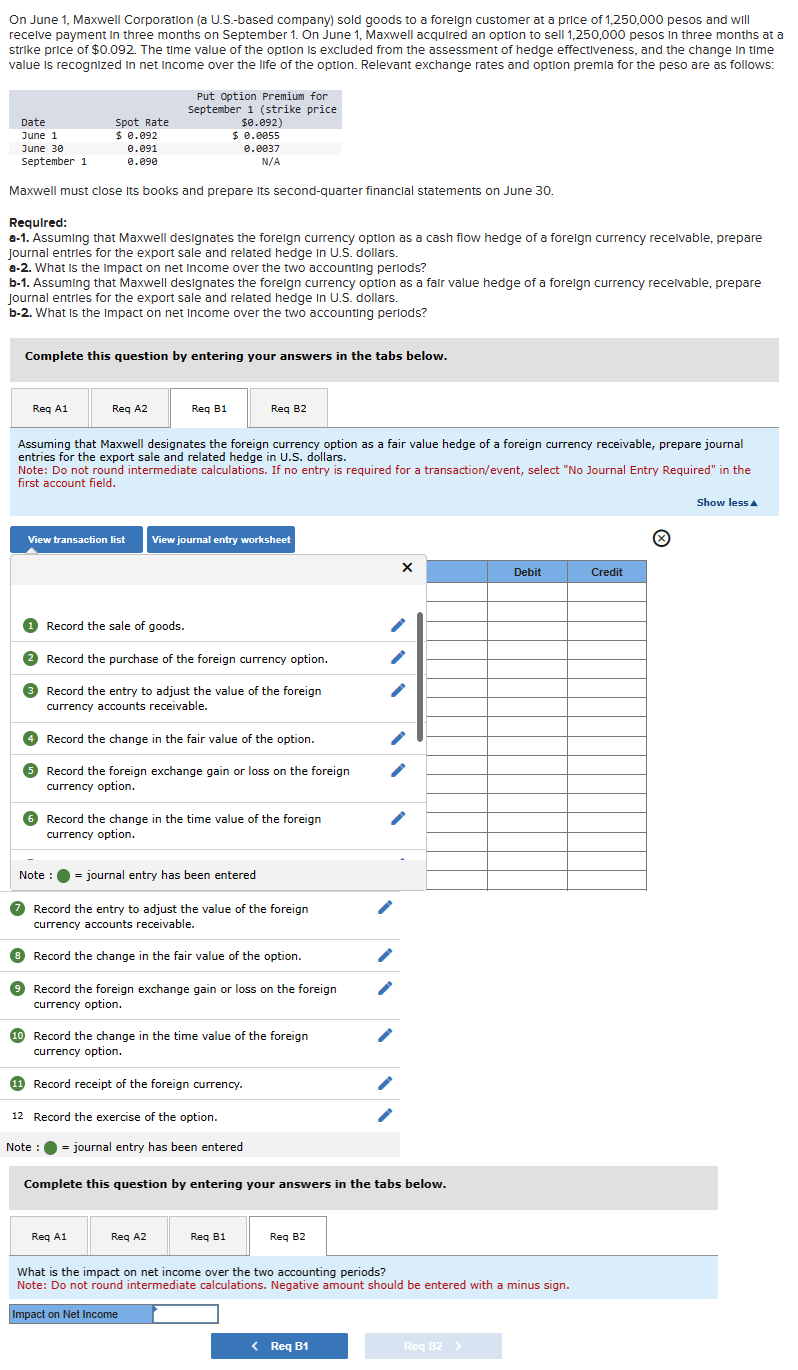

Question: On June 1 , Maxwell Corporation ( a U . S . - based company ) sold goods to a forelgn customer at a price

On June Maxwell Corporation a USbased company sold goods to a forelgn customer at a price of pesos and will

recelve payment In three months on September On June Maxwell acquired an option to sell pesos in three months at a

strike price of $ The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time

value is recognized in net income over the life of the option. Relevant exchange rates and option premla for the peso are as follows:

Maxwell must close its books and prepare its secondquarter financlal statements on June

Required:

a Assuming that Maxwell designates the foreign currency option as a cash flow hedge of a foreign currency recelvable, prepare

Journal entrles for the export sale and related hedge in US dollars.

a What is the Impact on net income over the two accounting periods?

b Assuming that Maxwell designates the forelgn currency option as a falr value hedge of a foreign currency recelvable, prepare

Journal entries for the export sale and related hedge in US dollars.

b What is the Impact on net Income over the two accounting perlods?

Complete this question by entering your answers in the tabs below.

Req A

Assuming that Maxwell designates the foreign currency option as a fair value hedge of a foreign currency receivable, prepare journal

entries for the export sale and related hedge in US dollars.

Note: Do not round intermediate calculations. If no entry is required for a transactionevent select No Journal Entry Required" in the

first account field.

Record the entry to adjust the value of the foreign

currency accounts receivable.

Record the change in the fair value of the option.

Record the foreign exchange gain or loss on the foreign

currency option.

Record the change in the time value of the foreign

currency option.

Record receipt of the foreign currency.

Record the exercise of the option.

Note : journal entry has been entered

Complete this question by entering your answers in the tabs below.

What is the impact on net income over the two accounting periods?

Note: Do not round intermediate calculations. Negative amount should be entered with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock