Question: On June 3 0 , 2 0 1 8 , Huxley Company sold some land to its parent company, Willow Corp for $ 4 7

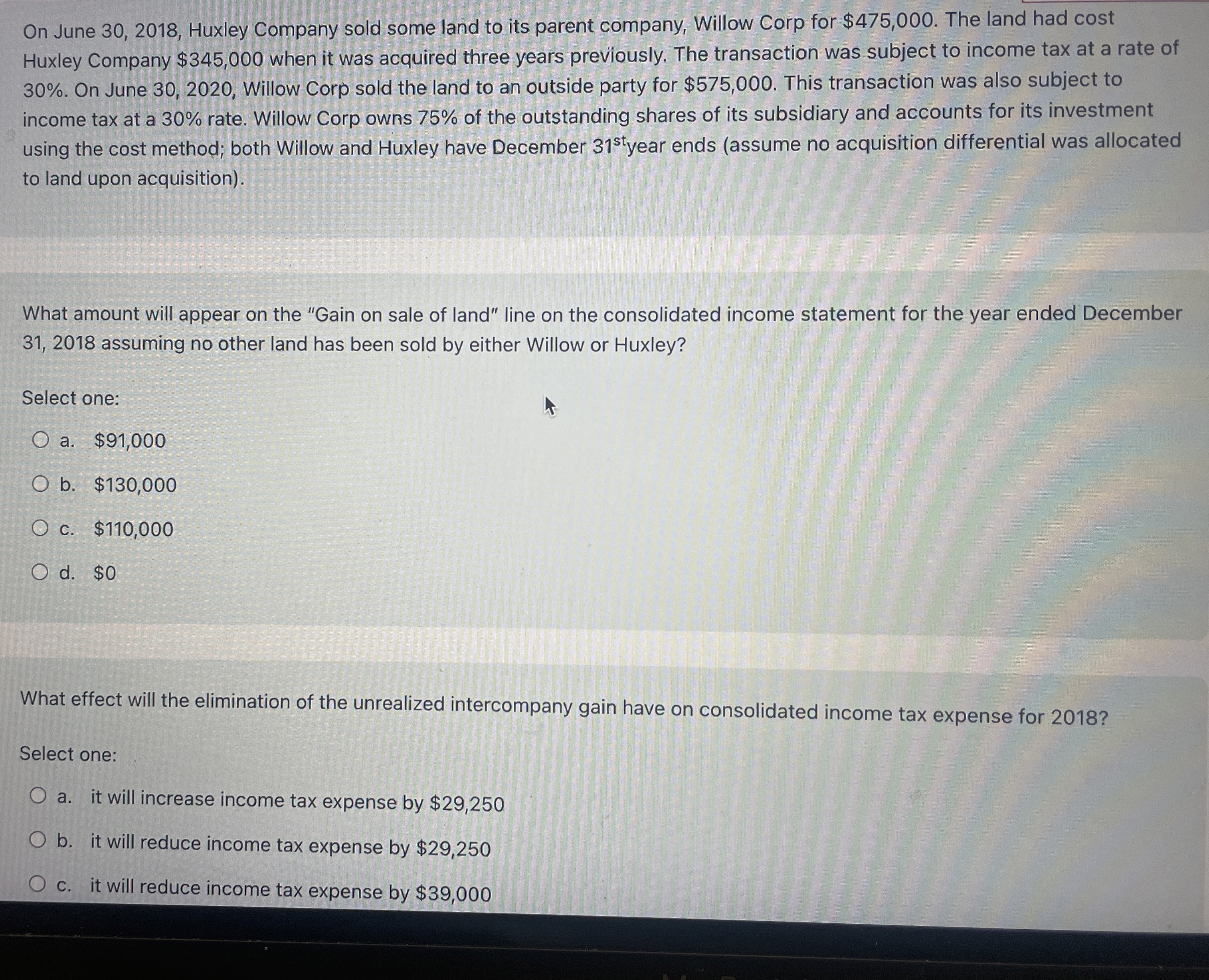

On June Huxley Company sold some land to its parent company, Willow Corp for $ The land had cost Huxley Company $ when it was acquired three years previously. The transaction was subject to income tax at a rate of On June Willow Corp sold the land to an outside party for $ This transaction was also subject to income tax at a rate. Willow Corp owns of the outstanding shares of its subsidiary and accounts for its investment using the cost method; both Willow and Huxley have December year ends assume no acquisition differential was allocated to land upon acquisition

What amount will appear on the "Gain on sale of land" line on the consolidated income statement for the year ended December assuming no other land has been sold by either Willow or Huxley?

Select one:

a $

b $

c $

d $

What effect will the elimination of the unrealized intercompany gain have on consolidated income tax expense for

Select one:

a it will increase income tax expense by $

b it will reduce income tax expense by $

c it will reduce income tax expense by $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock