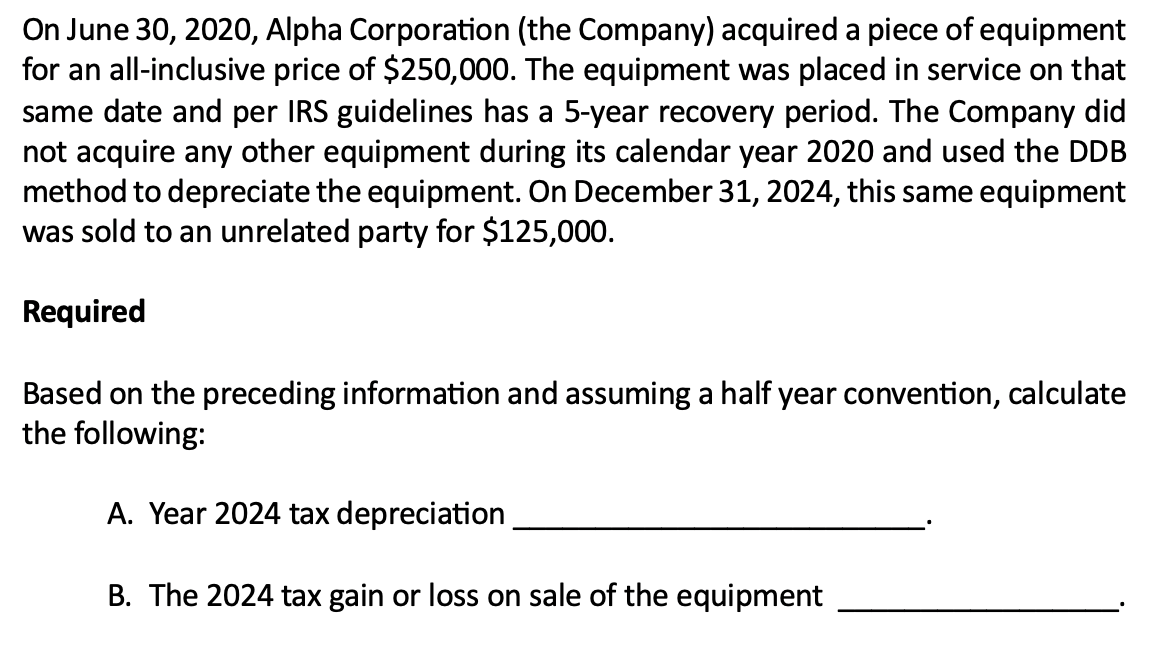

Question: On June 3 0 , 2 0 2 0 , Alpha Corporation ( the Company ) acquired a piece of equipment for an all -

On June Alpha Corporation the Company acquired a piece of equipment for an allinclusive price of $ The equipment was placed in service on that same date and per IRS guidelines has a year recovery period. The Company did not acquire any other equipment during its calendar year and used the DDB method to depreciate the equipment. On December this same equipment was sold to an unrelated party for $ Required Based on the preceding information and assuming a half year convention, calculate the following: A Year tax depreciation B The tax gain or loss on sale of the equipment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock