Question: On June 3 0 , 2 0 2 1 , Plaster, Inc., paid $ 8 9 2 , 0 0 0 for 8 0 percent

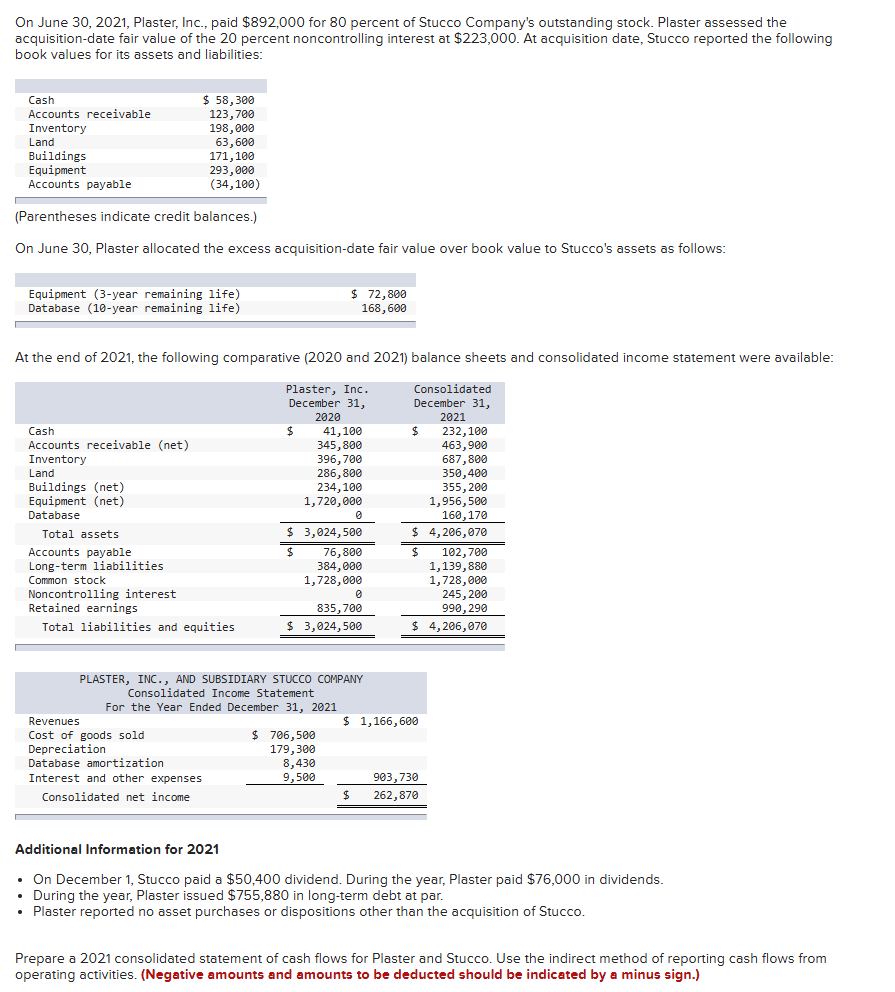

On June Plaster, Inc., paid $ for percent of Stucco Company's outstanding stock. Plaster assessed the acquisitiondate fair value of the percent noncontrolling interest at $ At acquisition date, Stucco reported the following book values for its assets and liabilities: Cash$Accounts receivableInventoryLandBuildingsEquipmentAccounts payableParentheses indicate credit balances. On June Plaster allocated the excess acquisitiondate fair value over book value to Stucco's assets as follows: Prepare a consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities. Negative amounts and amounts to be deducted should be indicated by a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock