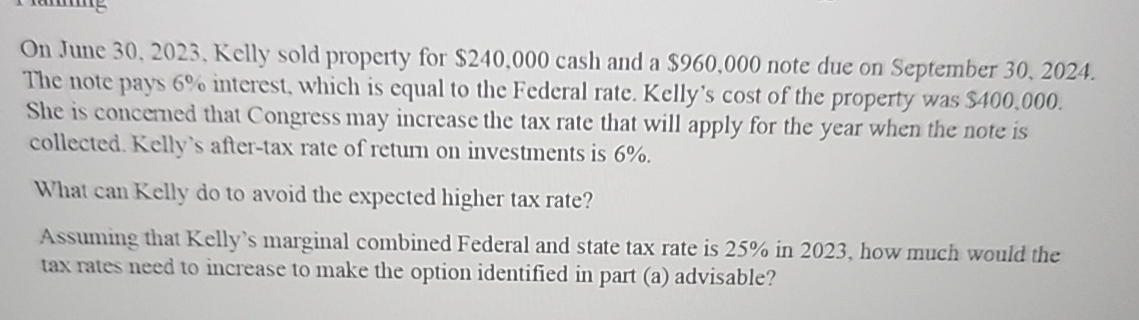

Question: On June 3 0 , 2 0 2 3 , Kelly sold property for $ 2 4 0 , 0 0 0 cash and a

On June Kelly sold property for $ cash and a $ note due on September

The note pays interest, which is equal to the Federal rate. Kelly's cost of the property was $

She is concemed that Congress may increase the tax rate that will apply for the year when the note is

collected. Kelly's aftertax rate of return on investments is

What can Kelly do to avoid the expected higher tax rate?

Assuming that Kelly's marginal combined Federal and state tax rate is in how much would the

tax rates need to increase to make the option identified in part a advisable?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock