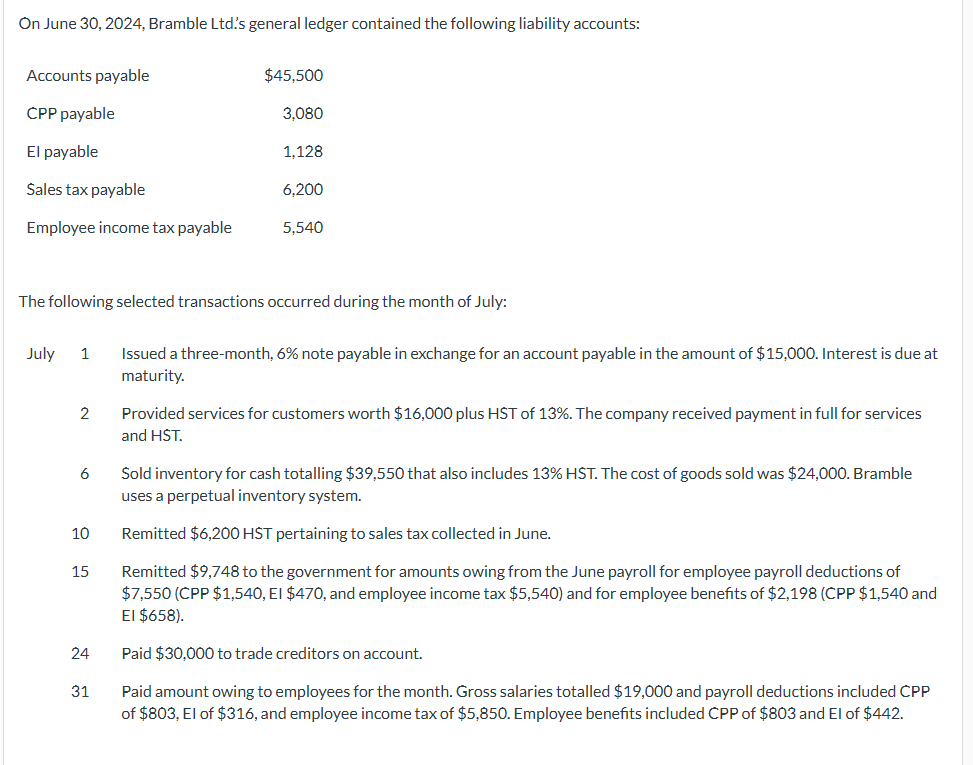

Question: On June 3 0 , 2 0 2 4 , Bramble Ltd . ' s general ledger contained the following liability accounts: Accounts Payable $

On June Bramble Ltds general ledger contained the following liability accounts:

Accounts Payable $

CPP Payable

EI Payable

Sales Tax payable

Employee income tax payable

The following selected transactions occurred during the month of July:

July Issued a threemonth, note payable in exchange for an account payable in the amount of $ Interest is due at maturity.

Provided services for customers worth $ plus HST of The company received payment in full for services and HST

Sold inventory for cash totalling $ that also includes HST The cost of goods sold was $ Bramble uses a perpetual inventory system.

Remitted $ HST pertaining to sales tax collected in June.

Remitted $ to the government for amounts owing from the June payroll for employee payroll deductions of $CPP $ EI $ and employee income tax $ and for employee benefits of $CPP $ and El $

Paid $ to trade creditors on account.

Paid amount owing to employees for the month. Gross salaries totalled $ and payroll deductions included CPP of $ El of $ and employee income tax of $ Employee benefits included CPP of $ and El of $

c Prepare the current liabilities section of the statement of financial position at July I already tried accounts payable $ or account payable $ and those were both wrong

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock