Question: On June 3 0 , 2 0 2 4 , Georgia - Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls

On June GeorgiaAtlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for GeorgiaAtlantic to make semiannual lease payments of $ over a fiveyear lease term, payable each June and December with the first payment on June GeorgiaAtlantic's incremental borrowing rate is the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straightline basis at the end of each fiscal year. The fair value of the equipment is $ million.

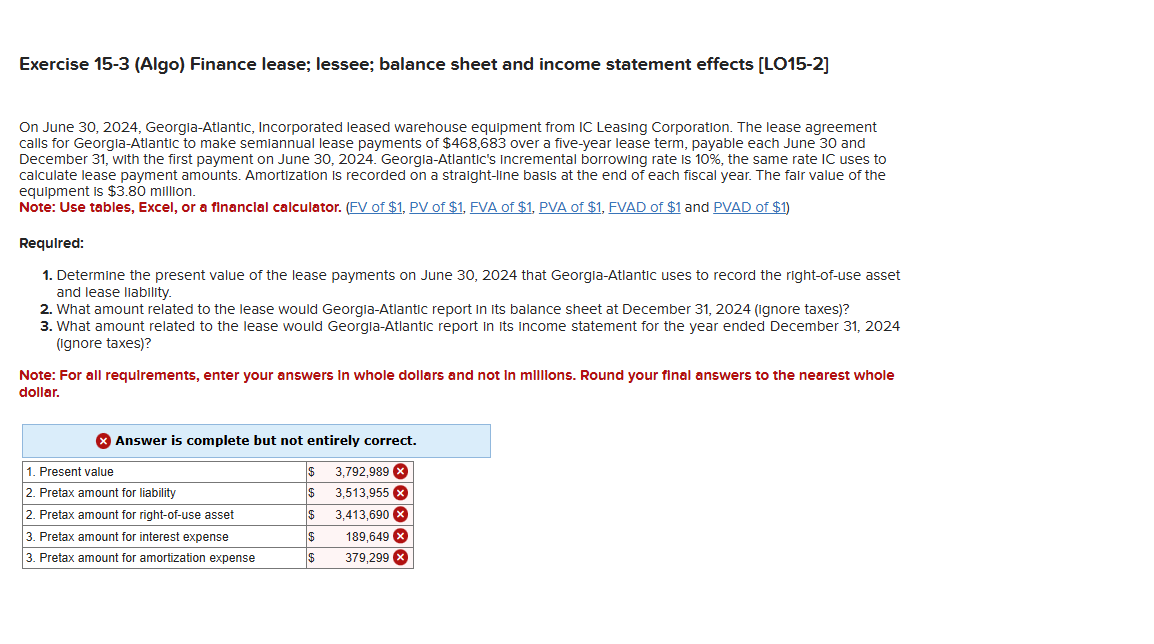

Exercise Algo Finance lease; lessee; balance sheet and income statement effects LO

On June GeorglaAtlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for GeorglaAtlantic to make semlannual lease payments of $ over a fiveyear lease term, payable each June and December with the first payment on June GeorglaAtlantic's Incremental borrowing rate Is the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straightline basis at the end of each fiscal year. The fair value of the equipment is $ million.

Note: Use tables, Excel, or a financlal calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Required:

Determine the present value of the lease payments on June that GeorgiaAtlantic uses to record the rightofuse asset and lease llability.

What amount related to the lease would GeorgiaAtlantic report in its balance sheet at December ignore taxes

What amount related to the lease would GeorgiaAtlantic report in its income statement for the year ended December Ignore taxes

Note: For all requirements, enter your answers In whole dollars and not In millions. Round your final answers to the nearest whole dollar. Exercise Algo Finance lease; lessee; balance sheet and income statement effects LO

On June GeorglaAtlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for GeorglaAtlantic to make semlannual lease payments of $ over a fiveyear lease term, payable each June and December with the first payment on June GeorglaAtlantic's Incremental borrowing rate is the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straightline basis at the end of each fiscal year. The fair value of the equipment is $ million.

Note: Use tables, Excel, or a financlal calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Required:

Determine the present value of the lease payments on June that GeorgiaAtlantic uses to record the rightofuse asset and lease llability.

What amount related to the lease would GeorgiaAtlantic report in its balance sheet at December ignore taxes

What amount related to the lease would GeorglaAtlantic report in its income statement for the year ended December Ignore taxes

Note: For all requirements, enter your answers in whole dollars and not In millions. Round your final answers to the nearest whole dollar.

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock