Question: On June 3 0 , 2 0 2 4 , Plaster, Incorporated, paid ( $ 8 6 0 , 0 0 0

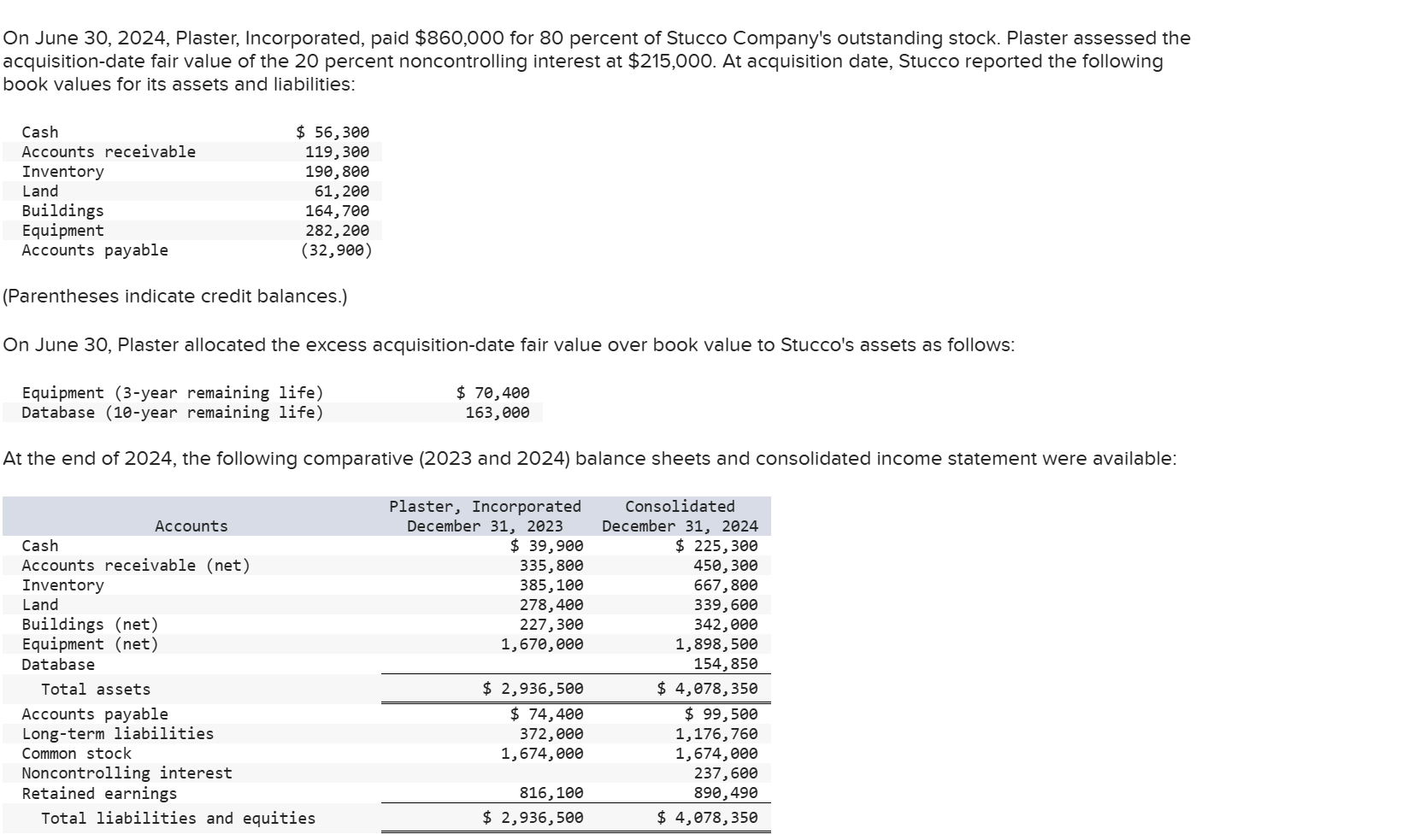

On June Plaster, Incorporated, paid $ for percent of Stucco Company's outstanding stock. Plaster assessed the acquisitiondate fair value of the percent noncontrolling interest at $ At acquisition date, Stucco reported the following book values for its assets and liabilities: Parentheses indicate credit balances. On June Plaster allocated the excess acquisitiondate fair value over book value to Stucco's assets as follows: At the end of the following comparative and balance sheets and consolidated income statement were available:Plaster, Incorporated December Consolidated December PLASTER, INCORPORATED, AND SUBSIDIARY STUCCO COMPANY Consolidated Income Statement For the Year Ended December

Additional Information for

On December Stucco paid a $ dividend. During the year, Plaster paid $ in dividends.

During the year, Plaster issued $ in longterm debt at par.

Plaster reported no asset purchases or dispositions other than the acquisition of Stucco.

Required:

Prepare a consolidated statement of cash flows for Plaster and Stucco. Use the indirect method of reporting cash flows from operating activities.

Note: Negative amounts and amounts to be deducted should be indicated by a minus sign. begintabularlll

hline multicolumncPLASTER INCORPORATED, AND SUBSIDIARY STUCCO COMPANY

hline multicolumncConsolidated Statement of Cash Flows

hline multicolumncFor the Year Ended December

hline Cash flows from operating activities: & &

hline & &

hline & &

hline & &

hline & &

hline & &

hline & &

hline & &

hline & &

hline Cash flows from investing activities: & &

hline & &

hline & &

hline & &

hline Cash flows from financing activities: & &

hline & &

hline & &

hline & &

hline & &

hline & &

hline Beginning cash, & &

hline Ending cash, & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock