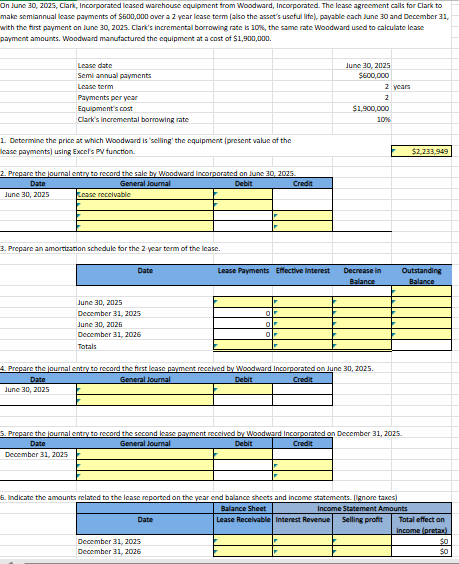

Question: On June 3 0 , 2 0 2 5 , Clark, Incorporated leased warehouse equipment from Woodward, Incorporated. The Icaae agreoment calls for Clark to

On June Clark, Incorporated leased warehouse equipment from Woodward, Incorporated. The Icaae agreoment calls for Clark to make semiannual lease payments of $ over a year lease term also the awset's uscfull life payable each June and December with the first payment on June Clark's incremental borrowing rate is the same rate Woodward used to calculate lease payment amounts. Woodward manufactured the equipment at a cost of $ Determine the price at which Woodword is 'selling' the equipment present value of the lease paryments using Excels PV function. Prepare the journal entry to rocord the sale by Woodward Incorporated on June Prepare the journal entry to record the first lease payment recehed by Woodward Incorporated on June Prepare the journal entry to record the sccond logee payment recelved by Woodword Incorporated on December Indicate the amounts related to the lease reported on the year cond balance shocts and income statements. Ignore tawes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock