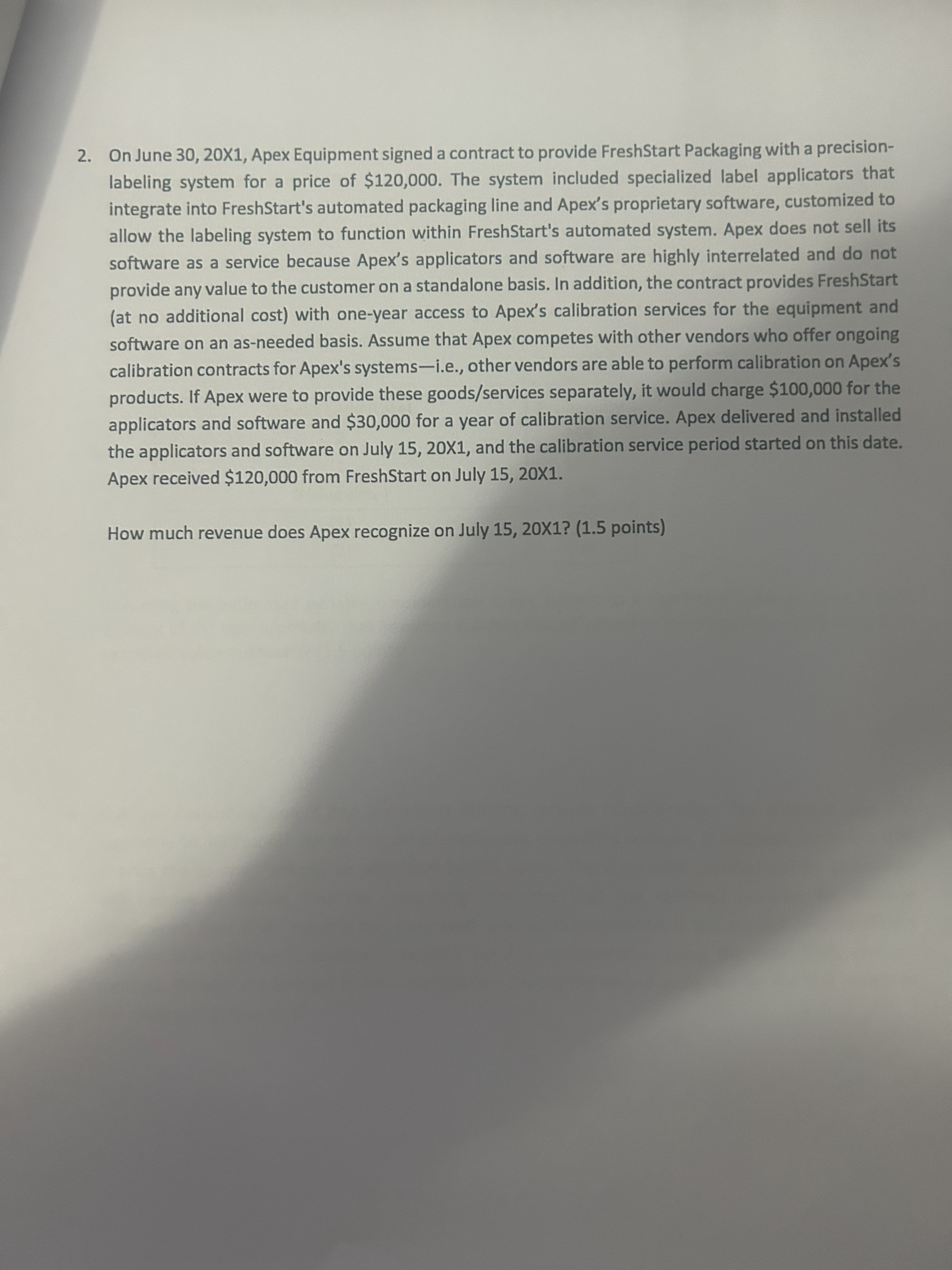

Question: On June 3 0 , 2 0 X 1 , Apex Equipment signed a contract to provide FreshStart Packaging with a precision - labeling system

On June X Apex Equipment signed a contract to provide FreshStart Packaging with a precision

labeling system for a price of $ The system included specialized label applicators that

integrate into FreshStart's automated packaging line and Apex's proprietary software, customized to

allow the labeling system to function within FreshStart's automated system. Apex does not sell its

software as a service because Apex's applicators and software are highly interrelated and do not

provide any value to the customer on a standalone basis. In addition, the contract provides FreshStart

at no additional cost with oneyear access to Apex's calibration services for the equipment and

software on an asneeded basis. Assume that Apex competes with other vendors who offer ongoing

calibration contracts for Apex's systemsie other vendors are able to perform calibration on Apex's

products. If Apex were to provide these goodsservices separately, it would charge $ for the

applicators and software and $ for a year of calibration service. Apex delivered and installed

the applicators and software on July X and the calibration service period started on this date.

Apex received $ from FreshStart on July

How much revenue does Apex recognize on July X points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock