Question: On ( June 3 ) , a corn farmer plans to harvest and sell 6 0 , 0 0 0 bushels of corn in the

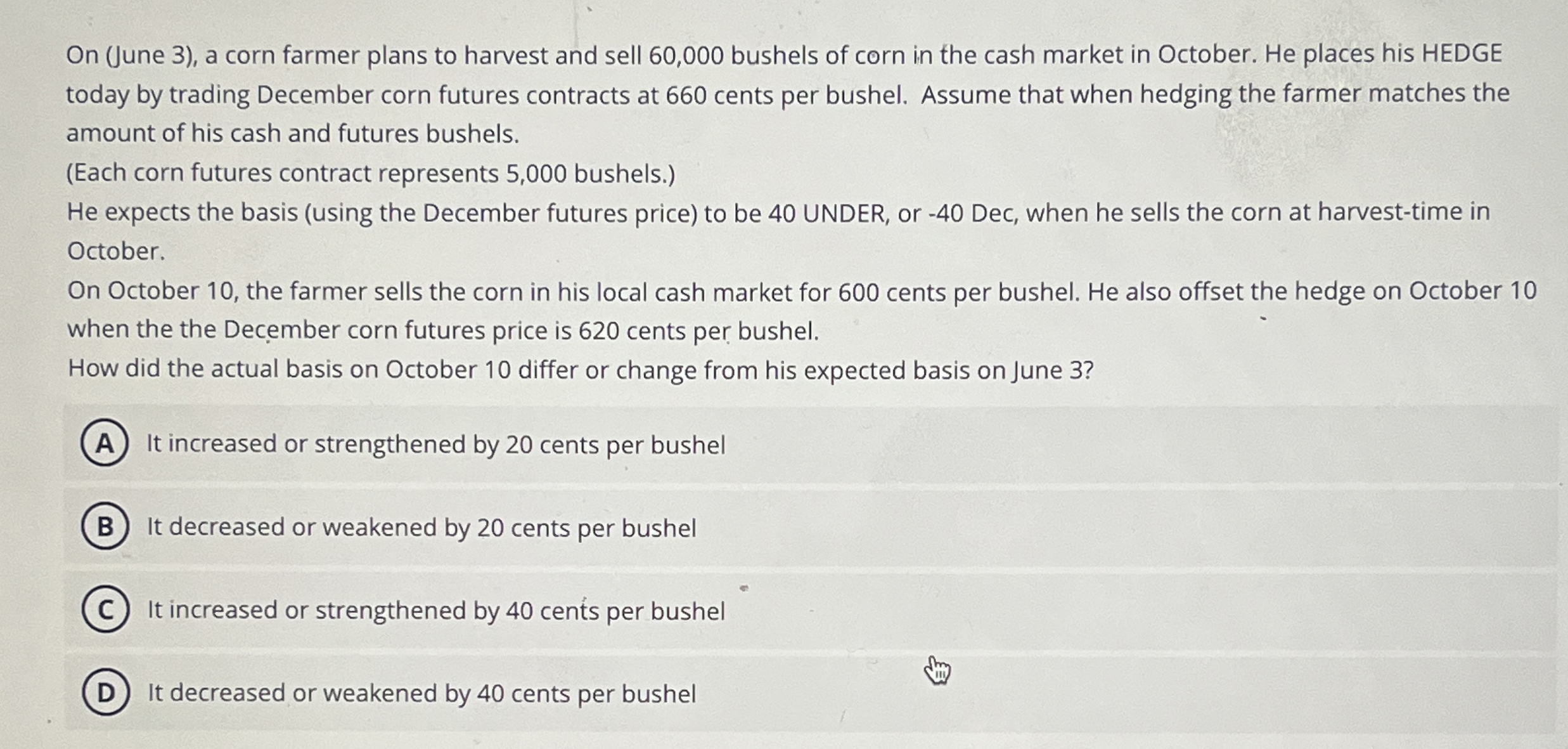

On June a corn farmer plans to harvest and sell bushels of corn in the cash market in October. He places his HEDGE today by trading December corn futures contracts at cents per bushel. Assume that when hedging the farmer matches the amount of his cash and futures bushels.

Each corn futures contract represents bushels.

He expects the basis using the December futures price to be UNDER, or Dec, when he sells the corn at harvesttime in October.

On October the farmer sells the corn in his local cash market for cents per bushel. He also offset the hedge on October when the the December corn futures price is cents per bushel.

How did the actual basis on October differ or change from his expected basis on June

It increased or strengthened by cents per bushel

It decreased or weakened by cents per bushel

It increased or strengthened by cents per bushel

It decreased or weakened by cents per bushel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock