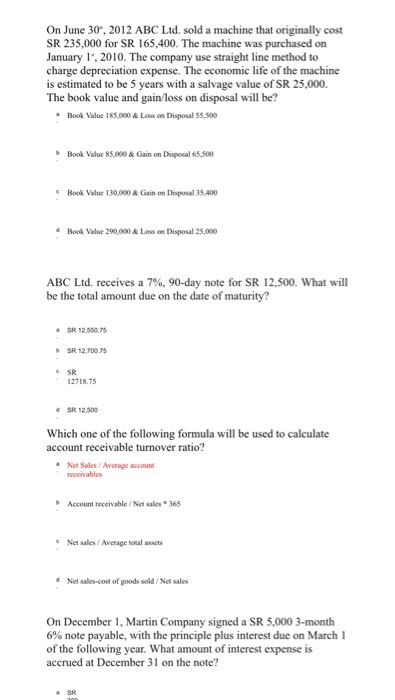

Question: On June 30, 2012 ABC Ltd. sold a machine that originally cost SR 235,000 for SR 165,400. The machine was purchased on January 15, 2010.

On June 30, 2012 ABC Ltd. sold a machine that originally cost SR 235,000 for SR 165,400. The machine was purchased on January 15, 2010. The company use straight line method to charge depreciation expense. The economic life of the machine is estimated to be 5 years with a salvage value of SR 25,000 The book value and gain/loss on disposal will be Book Value 185,000 & Los en Disposal 35,500 Book Value 85,000 & Gain on Disposal 65.500 Book Value 130.000 & Gain on Disposal 35,400 Book Value 290,000 & Loss on Disposal 25,000 ABC Ltd. receives a 7%, 90-day note for SR 12,500. What will be the total amount due on the date of maturity? SR 12.550.75 SR 12.700.75 SR 12718.75 SR 12.500 Which one of the following formula will be used to calculate account receivable turnover ratio? Net Sales / Average account receivables Account receivable / Net sales - 365 Net sales/ Average total assets Net sales-cost of goods soldNet sales On December 1, Martin Company signed a SR 5,000 3-month 6% note payable, with the principle plus interest due on March 1 of the following year. What amount of interest expense is accrued at December 31 on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts