Question: On June 30, 2024, the Esquire Company sold some merchandise to a customer for $42,000. In payment, Esquire agreed to accept a 6% note requiring

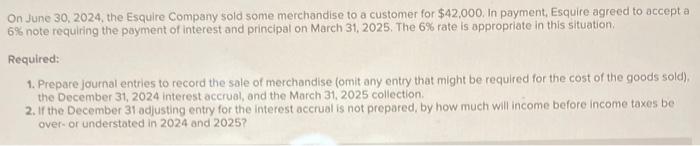

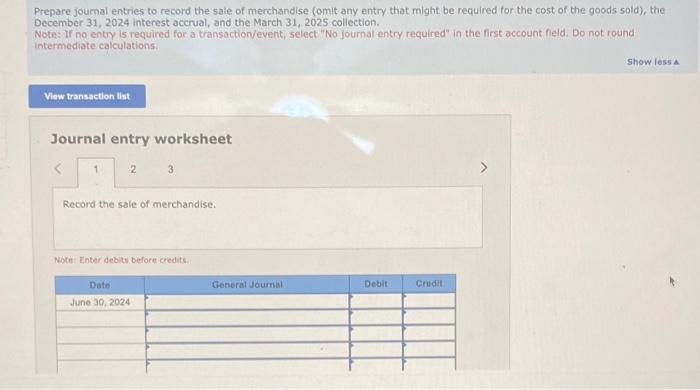

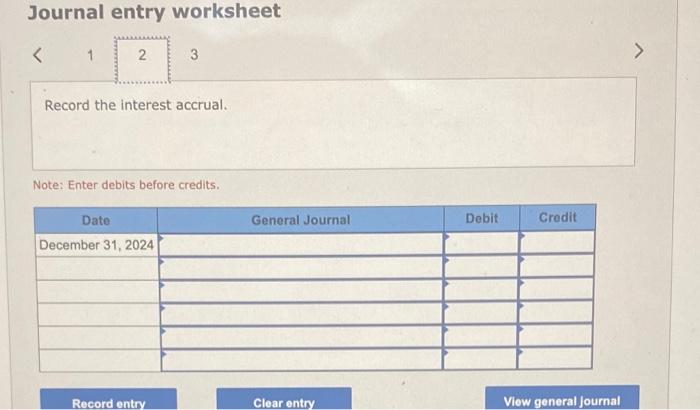

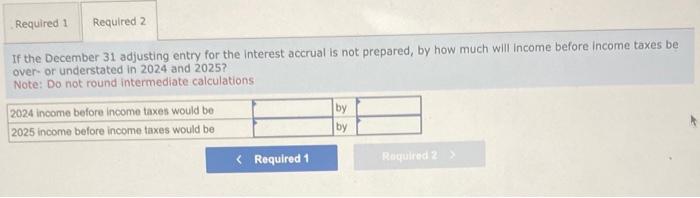

On June 30, 2024, the Esquire Company sold some merchandise to a customer for $42,000. In payment, Esquire agreed to accept a 6% note requiring the payment of interest and principal on March 31,2025 . The 6% rate is oppropriate in this situation. Required: 1. Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold). the December 31,2024 interest accrual, and the March 31,2025 collection. 2. If the December 31 adjusting entry for the interest accrual is not prepared, by how much will income before income taxes be over- or understated in 2024 and 2025 ? Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), the December 31, 2024 interest accrual, and the March 31, 2025 collection. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations: Journal entry worksheet 3 Journal entry worksheet Record the interest accrual. Note: Enter debits before credits. Journal entry worksheet Note: Enter deblts before credits. If the December 31 adjusting entry for the interest accrual is not prepared, by how much will income before income taxes be over-or understated in 2024 and 2025 ? Note: Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts