Question: On June 30,2024 , Single Computers issued 8% stated rate bonds with a face amo 2039 ( 15 years). The market rate of interest for

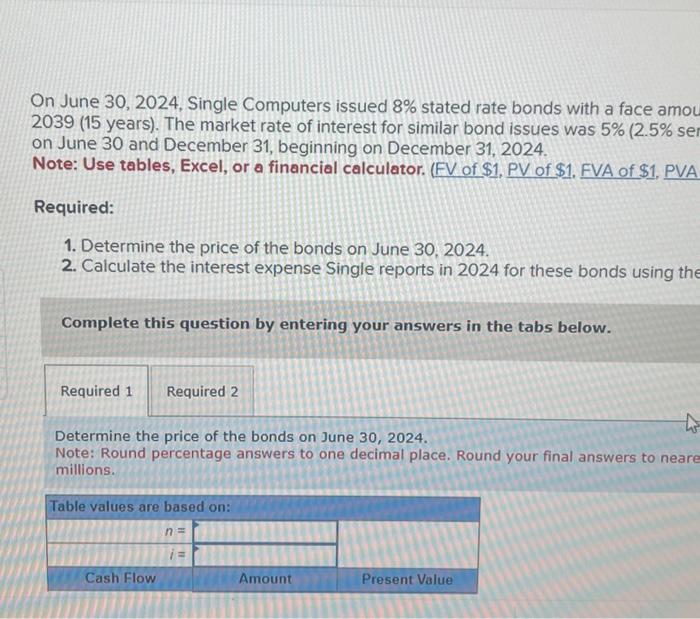

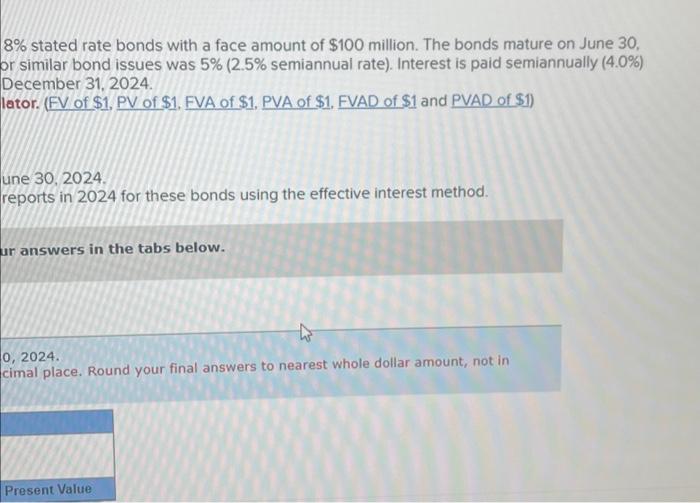

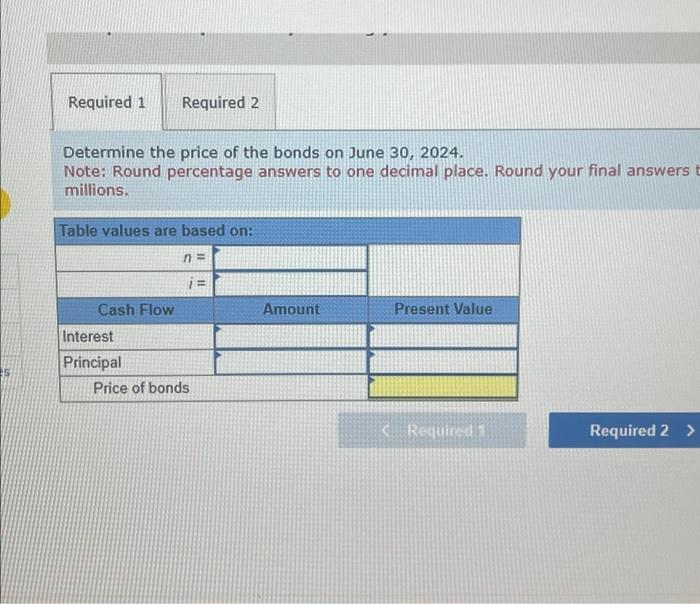

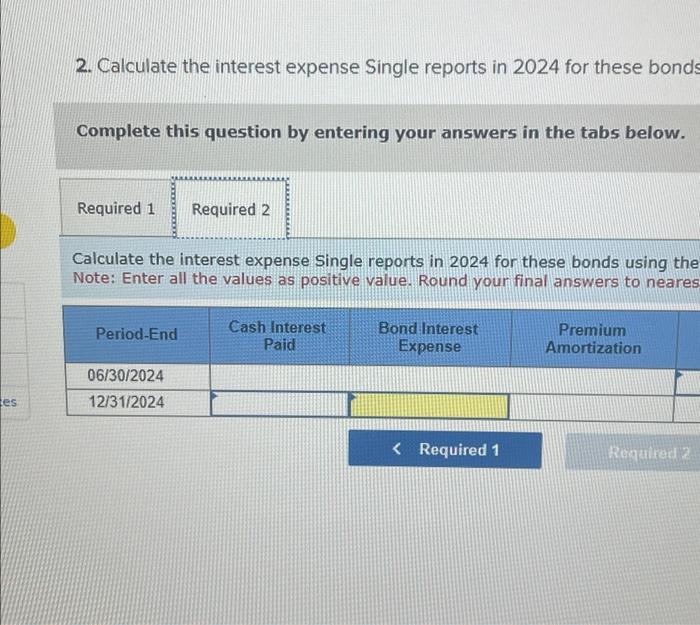

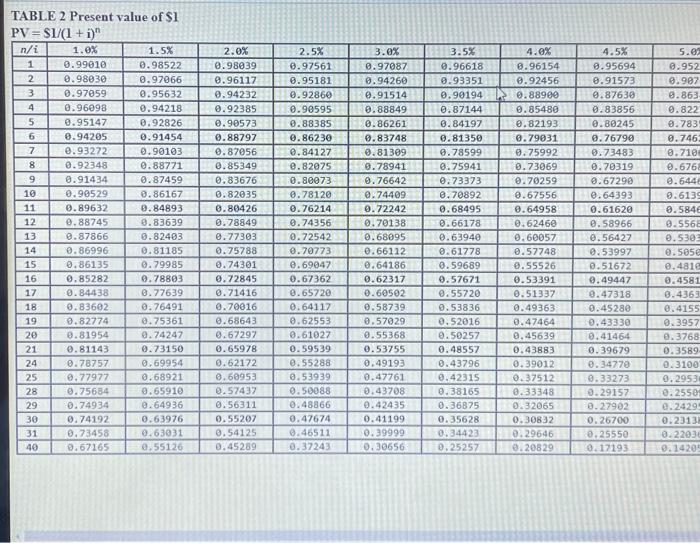

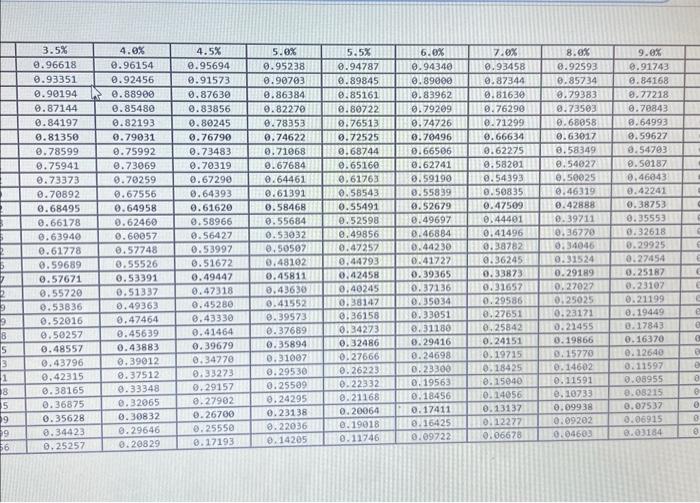

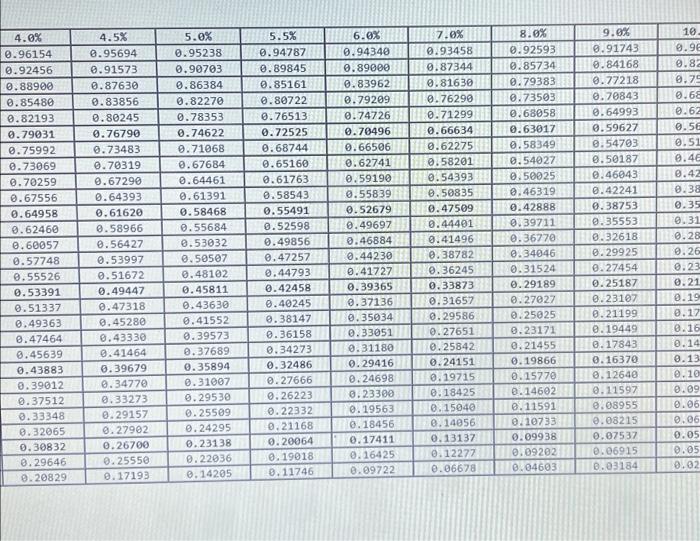

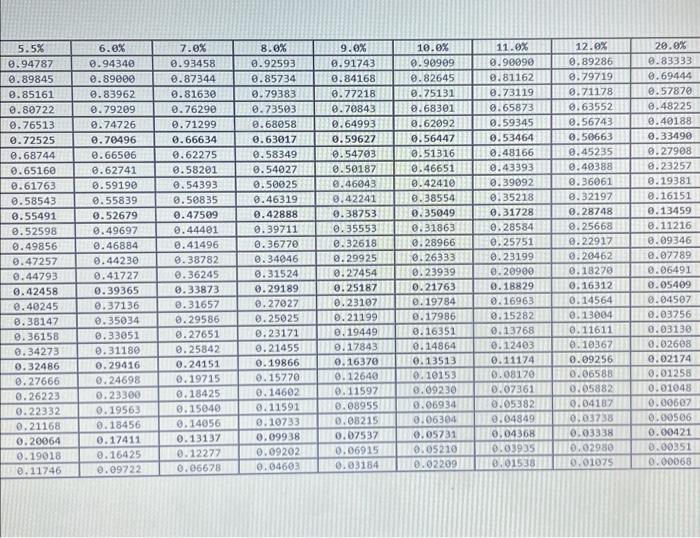

On June 30,2024 , Single Computers issued 8% stated rate bonds with a face amo 2039 ( 15 years). The market rate of interest for similar bond issues was 5% ( 2.5%se on June 30 and December 31, beginning on December 31, 2024. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1. FVA of \$1, PVA Required: 1. Determine the price of the bonds on June 30, 2024. 2. Calculate the interest expense Single reports in 2024 for these bonds using the Complete this question by entering your answers in the tabs below. Determine the price of the bonds on June 30, 2024. Note: Round percentage answers to one decimal place. Round your final answers to neare millions. Single reports in 2024 for these bonds using the effective interest method. ering your answers in the tabs below. gle reports in 2024 for these bonds using the effective interest method. ive value. Round your final answers to nearest whole dollar amount, not in millions. TABLE 2 Present value of $1 8% stated rate bonds with a face amount of $100 million. The bonds mature on June 30 , or similar bond issues was 5% ( 2.5% semiannual rate). Interest is paid semiannually (4.0%) December 31, 2024. lator. (FV of \$1, PV of \$1, FVA of \$1, PVA of \$1, FVAD of \$1 and PVAD of \$1) une 30,2024. reports in 2024 for these bonds using the effective interest method. answers in the tabs below. 0,2024 . cimal place. Round your final answers to nearest whole dollar amount, not in \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline 3.5% & 4.0% & 4.5% & 5.08 & 5.5x & 6.6% & 7.6x & 8.6x & 9.6% \\ \hline 0.96618 & 0.96154 & 0.95694 & 0.95238 & 0.94787 & 0.94340 & 0.93458 & 0.92593 & 0.91743 \\ \hline 0.93351 & 0.92456 & 0.91573 & 0.90703 & 0.89845 & 0.89000 & 0.87344 & 0.85734 & 0.84168 \\ \hline 0.90194 & 0.88900 & 0.87630 & 0.86384 & 8.85161 & 0.83962 & 0.81630 & 0.79383 & 0.77218 \\ \hline 0.87144 & 0.85480 & 0.83856 & 0.82270 & 0.80722 & 0.79209 & 0.76290 & 0.73503 & 0.70843 \\ \hline 0.84197 & 0.82193 & 0.80245 & 0.78353 & 0.76513 & 0.74726 & 0.71299 & 0.68058 & 8.64993 \\ \hline 0.81350 & 0.79031 & 0.76790 & 0.74622 & 0.72525 & 0.70496 & 0.66634 & 0.63017 & 0.59627 \\ \hline 0.78599 & 0.75992 & 0.73483 & 0.71068 & 0.68744 & 0.66506 & 0.62275 & 0.58349 & 0.54703 \\ \hline 0.75941 & 0.73069 & 0.70319 & 0.67684 & 0.65160 & 0.62741 & 0.58201 & 0.54027 & 0.50187 \\ \hline 0.73373 & 0.70259 & 0.67290 & 0.64461 & 0.61763 & 0.59190 & 0.54393 & 0.50025 & 0.46943 \\ \hline 0.70892 & 0.67556 & 0.64393 & 0.61391 & 0.58543 & 0.55839 & 0.50835 & 0.46319 & 0.42241 \\ \hline 0.68495 & 0.64958 & 0.61620 & 0.58468 & 0.55491 & 0.52679 & 0.47509 & 0.42888 & 0.38753 \\ \hline 0.66178 & 0.62460 & 0.58966 & 0.55684 & 0.52598 & 0.49697 & 0.44401 & 0.39711 & 0.35553 \\ \hline 0.63940 & 0.60057 & 0.56427 & 0.53032 & 0.49856 & 0.46884 & 0.41496 & 0.36770 & 0.32618 \\ \hline 0.61778 & 0.57748 & 0.53997 & 0.50507 & 0.47257 & 0.44230 & 0.38782 & 0.34046 & 0.29925 \\ \hline 0.59689 & 0.55526 & 0.51672 & 0.48102 & 0,44793 & 0.41727 & 0.36245 & 0.31524 & 0.27454 \\ \hline 0.57671 & 0.53391 & 0.49447 & 0.45811 & 0.42458 & 0.39365 & 0.33873 & 0.29189 & 0.25187 \\ \hline 0.55720 & 0.51337 & 0.47318 & 0.43630 & 0,40245 & 0.37136 & 0.31657 & 0.27027 & 0.23107 \\ \hline 0.53836 & 0.49363 & 0.45280 & 0.41552 & 0.38147 & 0.35034 & 0.29586 & 0.25025 & 0.21199 \\ \hline 0.52016 & 0.47464 & 0.43330 & 0.39573 & 0.36158 & 0.33951 & 0.27651 & 0.23171 & 0.19449 \\ \hline 0.50257 & 0.45639 & 0.41464 & 0.37689 & 0.34273 & 0.31180 & 0.25842 & 0.22455 & 0.17843 \\ \hline 0.48557 & 0.43883 & 0.39679 & 0.35894 & 0.32486 & 0.29416 & 0.24151 & 0.19866 & 0.16370 \\ \hline 0.43796 & 0.39012 & 0.34770 & 0.31007 & 0.27666 & 0.24698 & 0.19715 & 0.15770 & 0.12640 \\ \hline 0.42315 & 0.37512 & 0.33273 & 0.29530 & 0.26223 & 0.23300 & 0.18425 & 0.14602 & 0.11597 \\ \hline 0.38165 & 0.33348 & 0.29157 & 0.25509 & 0.22332 & 0.19563 & 0.15040 & 0.11591 & 0.08955 \\ \hline 0.36875 & 0.32065 & 0.27902 & 0.24295 & 0.21168 & 0.18456 & 0.14056 & 0.10733 & 0.08215 \\ \hline 0.35628 & 0.30832 & 0.26700 & 0.23138 & 0.20064 & 0.17411 & 0.13137 & 0.09938 & 0.07537 \\ \hline 0.34423 & 0.29646 & 0.25550 & 0.22036 & 0.19018 & 0.16425 & 0.12277 & 0.09202 & 0.06915 \\ \hline 0.25257 & 0.20829 & 0.17193 & 0.14205 & 0.11746 & 0.09722 & 0.06678 & 0.04603 & 0.03184 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline 5.5% & 6.0% & 7.0% & 8.0% & 9.0% & 10.0% & 11.6% & 12.0% & 20.0% \\ \hline 0.94787 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.90909 & 0.96090 & 0.89286 & 0.83333 \\ \hline 0.89845 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.82645 & 0.81162 & 0.79719 & 0.69444 \\ \hline 0.85161 & 0.83962 & 0.81630 & 0.79383 & 0.77218 & 0.75131 & 0.73119 & 0.71178 & 0.57870 \\ \hline 0.80722 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.68301 & 0.65873 & 0.63552 & 0.48225 \\ \hline 0.76513 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62092 & 0.59345 & 0.56743 & 0.49188 \\ \hline 0.72525 & 0.70496 & 0.66634 & 0.63017 & 0.59627 & 0.56447 & 0.53464 & 0.56663 & 0.33490 \\ \hline 0.68744 & 0.66506 & 0.62275 & 0.58349 & 0.54703 & 0.51316 & 0.48166 & 0.45235 & 0.27908 \\ \hline 0.65160 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46651 & 0.43393 & 0.46388 & 0.23257 \\ \hline 0.61763 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42410 & 0.39992 & 0.36061 & 0.19381 \\ \hline 0.58543 & 0.55839 & 0.50835 & 0.46319 & 0.42241 & 0.38554 & 0.35218 & 0.32197 & 0.16151 \\ \hline 0.55491 & 0.52679 & 0.47509 & 0.42888 & 0.38753 & 0.35049 & 0.31728 & 0.28748 & 0.13459 \\ \hline 0.52598 & 0.49697 & 0.44401 & 0.39711 & 0.35553 & 0.31863 & 0.28584 & 0.25668 & 0.11216 \\ \hline 0.49856 & 0.46884 & 0.41496 & 0.36770 & 0.32618 & 0.28966 & 0.25751 & 0.22917 & 0.093446 \\ \hline 0.47257 & 0.44230 & 0.38782 & 0.34046 & 0.29925 & 0.26333 & 0.23199 & 0.20462 & 0.07789 \\ \hline 0.44793 & 0.41727 & 0.36245 & 0.31524 & 0.27454 & 0.23939 & 0.20900 & 0.13278 & 0.06491 \\ \hline 0.42458 & 0.39365 & 0.33873 & 0.29189 & 0.25187 & 0.21763 & 0.18829 & 0.16312 & 0.05409 \\ \hline 0.40245 & 0.37136 & 0.31657 & 0.27027 & 0.23107 & 0.19784 & 0.16963 & 0.14564 & 0.04507 \\ \hline 0.38147 & 0.35034 & 0.29586 & 0.25025 & 0.21199 & 0.17986 & 0.15282 & 0.13004 & 0.03756 \\ \hline 0.36158 & 0.33051 & 0.27651 & 0.23171 & 0.19449 & 0.16351 & 0.13768 & 0.11611 & 0.03130 \\ \hline 0.34273 & 0.31180 & 0.25842 & 0.21455 & 0.17843 & 0.14864 & 0.12403 & 0.10367 & 0.02608 \\ \hline 0.32486 & 0.29416 & 0.24151 & 0.19866 & 0.16370 & 0.13513 & 0.11174 & 0.09256 & 0.02174 \\ \hline 0.27666 & 0.24698 & 0.19715 & 0.15770 & 0.12640 & 0.10153 & 0.08170 & 0.06588 & 0.01258 \\ \hline 0.26223 & 0.23360 & 0.18425 & 0.14602 & 0.11597 & 0.09230 & 0.07361 & 0.05882 & 0.01048 \\ \hline 0.22332 & 0.19563 & 0.15640 & 0.11591 & 0.08955 & 0.06934 & 0.05382 & 0.04187 & 0.00607 \\ \hline 0.21168 & 0.18456 & 0.14656 & 0.10733 & 0.08215 & 0.06304 & 0.04849 & 0,03738 & 0.00506 \\ \hline 0.20064 & 0.17411 & 0.13137 & 0.09938 & 0.07537 & 0.05731 & 0.04368 & 0.03338 & 0.00421 \\ \hline 0.19018 & 0.16425 & 0.12277 & 0.09202 & 0.06915 & 0.05210 & 0.03935 & 0.02980 & 0.00351 \\ \hline 0.11746 & 0.09722 & 0.06678 & 0.04603 & 0.03184 & 0.02209 & 0.01538 & 0.01075 & 0.00068 \\ \hline \end{tabular} 2. Calculate the interest expense Single reports in 2024 for these bond Complete this question by entering your answers in the tabs below. Calculate the interest expense Single reports in 2024 for these bonds using the Note: Enter all the values as positive value. Round your final answers to neares \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline 4.0% & 4.5% & 5.0% & 5.5% & 6.68 & 7.6% & 8.0% & 9.0% & 10 \\ \hline 0.96154 & 0.95694 & 0.95238 & 0.94787 & 0.94340 & 0.93458 & 0.92593 & 0.91743 & 0.9 \\ \hline 0.92456 & 0.91573 & 0.90703 & 0.89845 & 0.89000 & 0.87344 & 0.85734 & 0.84168 & 0.8 \\ \hline 0.88900 & 0.87630 & 0.86384 & 0.85161 & 0.83962 & 0.81630 & 0.79383 & 0.77218 & 0.7 \\ \hline 0.85480 & 0.83856 & 0.82270 & 0.80722 & 0.79209 & 0.76290 & 0.73503 & 0.70843 & 0.6 \\ \hline 0.82193 & 0.80245 & 0.78353 & 0.76513 & 0.74726 & 0.71299 & 0.68058 & 0.64993 & 0.62 \\ \hline 0.79031 & 0.76790 & 0.74622 & 0.72525 & 0.76496 & 0.66634 & 0.63017 & 0.59627 & 0.5 \\ \hline 0.75992 & 0.73483 & 0.71068 & 0.68744 & 0.66506 & 0.62275 & 0.58349 & 0.54703 & 0.5 \\ \hline 0.73069 & 0.70319 & 0.67684 & 0.65160 & 0.62741 & 0.58201 & 0.54027 & 0.50187 & 0.46 \\ \hline 0.70259 & 0.67290 & 0.64461 & 0.61763 & 0.59190 & 0.54393 & 0.50025 & 0.46043 & 0.42 \\ \hline 0.67556 & 0.64393 & 0.61391 & 0.58543 & 0.55839 & 0.50835 & 0.46319 & 0.42241 & 0.38 \\ \hline 0.64958 & 0.61620 & 0.58468 & 0.55491 & 0.52679 & 0.47509 & 0.42888 & 0.38753 & 0.35 \\ \hline 0.62460 & 0.58966 & 0.55684 & 0.52598 & 0.49697 & 0.44401 & 0.39711 & 0.35553 & 0.31 \\ \hline 0.60057 & 0.56427 & 0.53032 & 0.49856 & 0.46884 & 0.41496 & 0.36770 & 0.32618 & 0.28 \\ \hline 0.57748 & 0.53997 & 0.50507 & 0.47257 & 0.44230 & 0.38782 & 0.34046 & 0.29925 & 0.26 \\ \hline 0.55526 & 0.51672 & 0.48102 & 0.44793 & 0.41727 & 0.36245 & 0.31524 & 0.27454 & 0.2 \\ \hline 0.53391 & 0.49447 & 0.45811 & 0.42458 & 0.39365 & 0.33873 & 0.29189 & 0.25187 & 0.21 \\ \hline 0.51337 & 0.47318 & 0.43630 & 0.40245 & 0.37136 & 0.31657 & 0.27027 & 0.23107 & 0.19 \\ \hline 0.49363 & 0.45280 & 0.41552 & 0.38147 & 0.35034 & 0.29586 & 0.25025 & 0.21199 & 0.1 \\ \hline 0.47464 & 0.43330 & 0.39573 & 0.36158 & 0.33051 & 0.27651 & 0.23171 & 0.19449 & 0.16 \\ \hline 0.45639 & 0.41464 & 0.37689 & 0.34273 & 0.31180 & 0.25842 & 0.21455 & 0.17843 & 0.1 \\ \hline 0.43883 & 0.39679 & 0.35894 & 0.32486 & 0.29416 & 0.24151 & 0.19866 & 0.16370 & 0.1 \\ \hline 0.39012 & 0.34770 & 0.31007 & 0.27666 & 0.24698 & 0.19715 & 0.15770 & 0.12640 & 0.10 \\ \hline 0.37512 & 0.33273 & 0.29530 & 0.26223 & 0.23300 & 0.18425 & 0.14602 & 0.11597 & 0.09 \\ \hline 0.33348 & 0.29157 & 0.25509 & 0.22332 & 0.19563 & 0.15040 & 0.11591 & 0.08955 & 0.06 \\ \hline 0.32065 & 0.27902 & 0.24295 & 0.21168 & 0.18456 & 0.14056 & 0.10733 & 0.08215 & 0.06 \\ \hline 0.30832 & 0.26700 & 0.23138 & 0.20064 & 0.17411 & 0.13137 & 0.09938 & 0.07537 & 0.05 \\ \hline 0.29646 & 0.25550 & 0.22036 & 0.19018 & 0.16425 & 0.12277 & 0.09202 & 0.06915 & 0.05 \\ \hline 0.20829 & 0.17193 & 0.14205 & 0.11746 & 0.09722 & 0.06678 & 0.04603 & 0.03184 & 0.02 \\ \hline \end{tabular} Determine the price of the bonds on June 30,2024 . Note: Round percentage answers to one decimal place. Round your final answers millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts