Question: On m average day, Plastics Enterprises writes 42 checks with an average amount of $587. These checks clear the bank in an average of 2

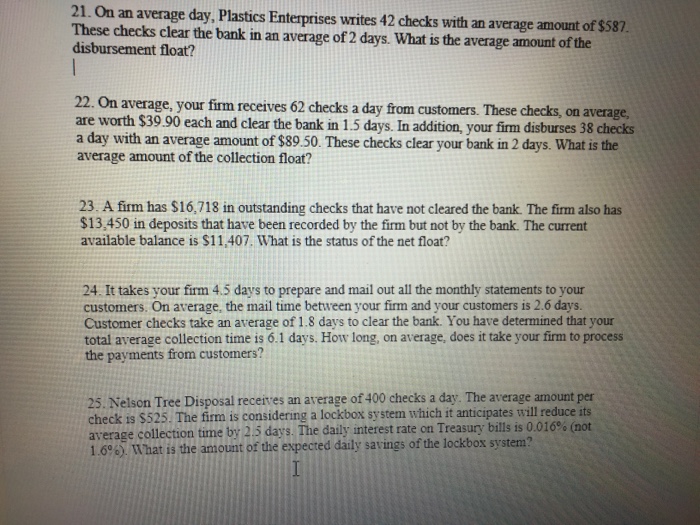

On m average day, Plastics Enterprises writes 42 checks with an average amount of $587. These checks clear the bank in an average of 2 days. What is the average amount of the disbursement float? On average, your firm receives 62 checks a day from customers. These checks, on average, are worth $39.90 each and clear the bank in 1.5 days. In addition, your firm disburses 38 checks a day with an average amount of $89.50. These checks clear your bank m 2 days. What is the average amount of the collection float? A firm has $16, 718 in outstanding checks that have not cleared the bank. The firm also has $13, 450 in deposits that have been recorded by the firm but not by the bank. The current available balance is $11, 407. What is the status of the net float? It takes your firm 4.5 days to prepare and mail out all the monthly statements to your customers. On average, the mail time between your firm and your customers is 2.6 days. Customer checks take an average of 1.8 days to clear the bank. You have determined that your total average collection time is 6.1 days. How long, on average, does it take your firm to process the payments from customers? Nelson Tree Disposal receives an average of400 checks a day. The average amount per check is $525. The firm is considering a lockbox system which it anticipates will reduce its average collection tune by 2.5 days. The daily interest rate on Treasury bills is 0.016%(not 1.6%). What is die amount of die expected daily savings of the lockbox system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts