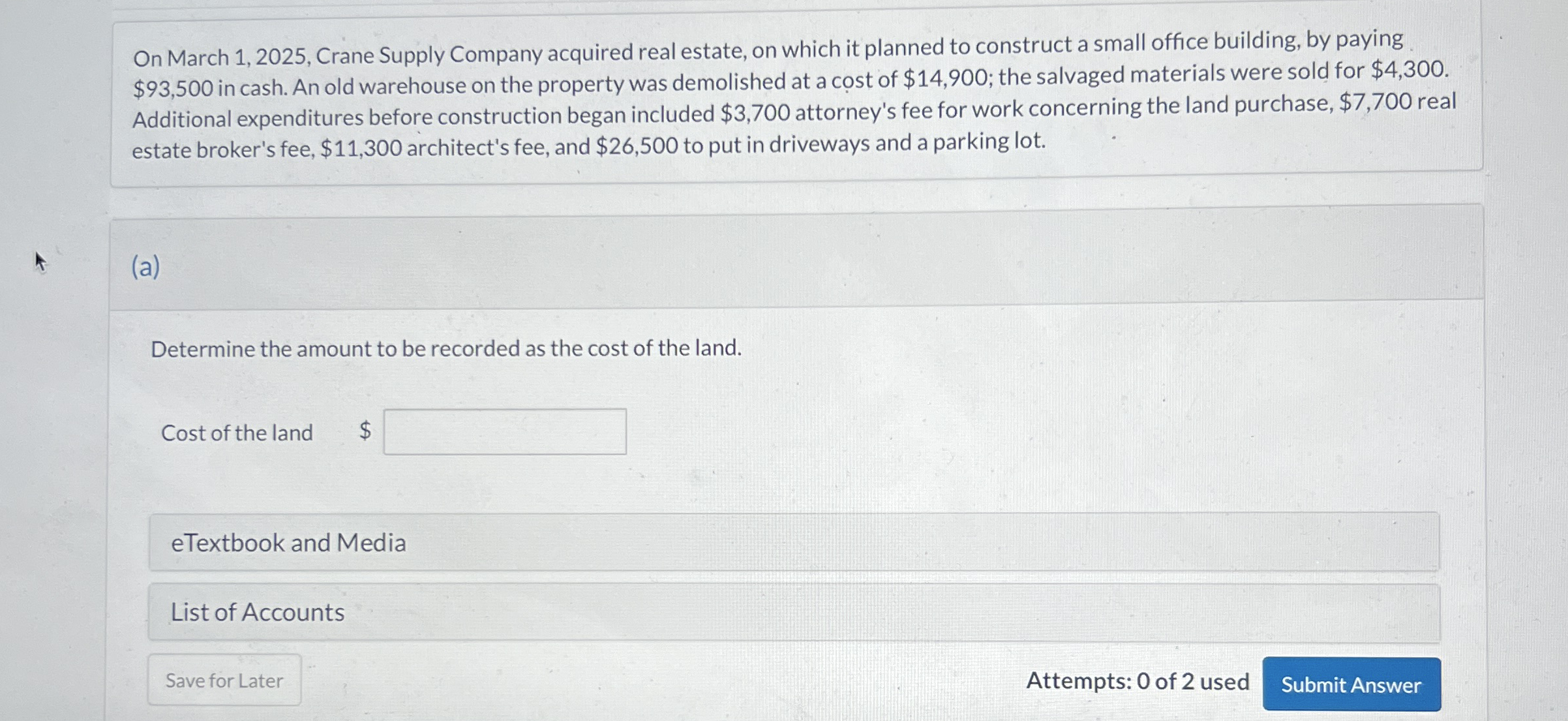

Question: On March 1 , 2 0 2 5 , Crane Supply Company acquired real estate, on which it planned to construct a small office building,

On March Crane Supply Company acquired real estate, on which it planned to construct a small office building, by paying $ in cash. An old warehouse on the property was demolished at a cost of $; the salvaged materials were sold for $ Additional expenditures before construction began included $ attorney's fee for work concerning the land purchase, $ real estate broker's fee, $ architect's fee, and $ to put in driveways and a parking lot.

a

Determine the amount to be recorded as the cost of the land.

Cost of the land $

eTextbook and Media

List of Accounts

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock