Question: On March 1, 2019, PT Maju purchased a cash supply of 500 boxes of fresh detergent soap merchandise @ 24 packs with a total purchase

On March 1, 2019, PT Maju purchased a cash supply of 500 boxes of fresh detergent soap merchandise @ 24 packs with a total purchase value of IDR 108,000,000. On April 1, 2019, all of the Fresh detergent merchandise inventory was sold in cash to PT Jaya at a price of IDR 144,000,000. As of December 31, 2019, 400 boxes were sold in cash. The sales value of Fresh detergent per box by PT Jaya is IDR 360,000.

On April 5, 2019, PT Maju purchased 500 dozen Green Coffee coffees at a price of IDR 54,000 per dozen from PT Jaya in cash. PT Jaya itself bought the Green Coffee coffee in cash at a price of IDR48,000 per dozen on March 31, 2019. During 2019, PT Maju sold 400 dozen Green Coffee coffees at a price of IDR 66,000 per dozen in cash. So, as of December 31, 2019, PT Maju has 100 dozen Green Coffee coffees. During 2019, PT Jaya announced a net profit of Rp1,200,000,000 and a cash dividend totalingRp300,000,000. PT Maju itself distributed cash dividends of IDR 500,000,000 during 2019.It is assumed that both PT Jaya and PT Maju use the perpetual inventory recording method.

Question:

a). Make a journal related to the sale and purchase of Fresh detergent soap and Green Coffee coffee from PT Maju and PT Jaya during 2019.

b). Calculation consolidated elimination journal. Make an Inventory consolidation calculation if necessary, to make calculations easier.

c). Prepare a consolidated working paper.

d). Prepare a consolidated profit and loss statement, a consolidated statement of retained earnings, and a consolidated statement of financial position for the period ended 31 December 2019.

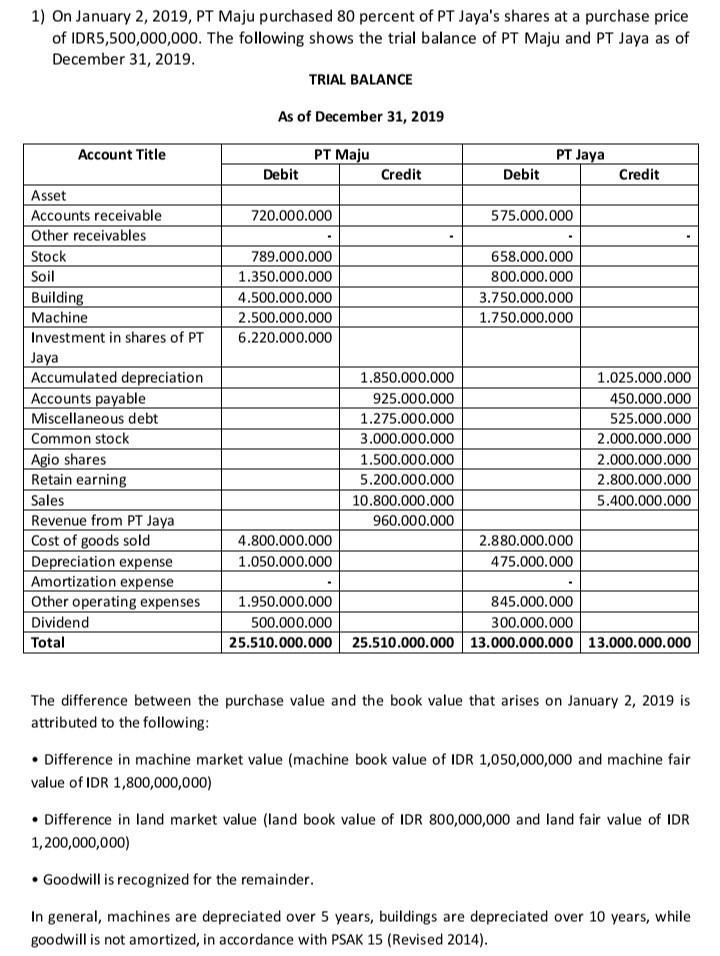

1) On January 2, 2019, PT Maju purchased 80 percent of PT Jaya's shares at a purchase price The following shows the trial balance of PT Maju and PT Jaya as of of IDR5,500,000,000. December 31, 2019. TRIAL BALANCE Account Title Asset Accounts receivable Other receivables Stock Soil Building Machine Investment in shares of PT Jaya Accumulated depreciation Accounts payable Miscellaneous debt Common stock Agio shares Retain earning Sales Revenue from PT Jaya Cost of goods sold Depreciation expense Amortization expense Other operating expenses Dividend Total As of December 31, 2019 Debit PT Maju 720.000.000 . 789.000.000 1.350.000.000 4.500.000.000 2.500.000.000 6.220.000.000 4.800.000.000 1.050.000.000 Credit 1.850.000.000 925.000.000 1.275.000.000 3.000.000.000 1.500.000.000 5.200.000.000 10.800.000.000 960.000.000 Debit PT Jaya 575.000.000 658.000.000 800.000.000 3.750.000.000 1.750.000.000 2.880.000.000 475.000.000 Credit 1.025.000.000 450.000.000 525.000.000 2.000.000.000 2.000.000.000 2.800.000.000 5.400.000.000 1.950.000.000 845.000.000 500.000.000 300.000.000 25.510.000.000 25.510.000.000 13.000.000.000 13.000.000.000 The difference between the purchase value and the book value that arises on January 2, 2019 is attributed to the following: Difference in machine market value (machine book value of IDR 1,050,000,000 and machine fair value of IDR 1,800,000,000) Difference in land market value (land book value of IDR 800,000,000 and land fair value of IDR 1,200,000,000) Goodwill is recognized for the remainder. In general, machines are depreciated over 5 years, buildings are depreciated over 10 years, while goodwill is not amortized, in accordance with PSAK 15 (Revised 2014).

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

A Journal related to the sale and purchase of Fresh detergent soap and Green Coffee coffee from PT Maju and PT Jaya during 2019 DebitCredit PT Maju March 1 2019 Inventory Fresh detergent108000000 Acco... View full answer

Get step-by-step solutions from verified subject matter experts