Question: On March 1 5 , 2 0 2 4 , Helen purchased and placed in service a new Acura MDX . The purchase price of

On March Helen purchased and placed in service a new Acura MDX The purchase price of the automobile was

$ and the vehicle had a rating of GVW The vehicle was used for business.

If required, round your answers to the nearest dollar.

Click here to access the depreciation table to use for this problem.

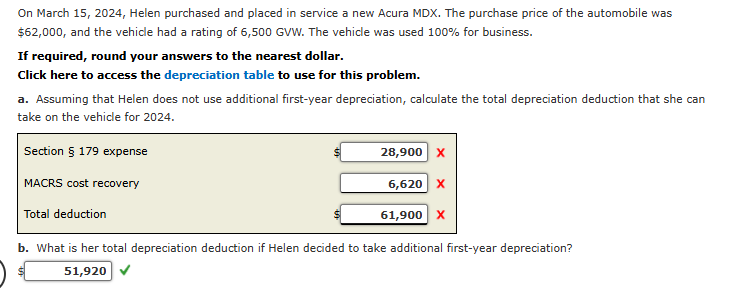

a Assuming that Helen does not use additional firstyear depreciation, calculate the total depreciation deduction that she can

take on the vehicle for

Section expense

MACRS cost recovery

Total deduction

b What is her total depreciation deduction if Helen decided to take additional firstyear depreciation?

$ NOTE THAT ARE ALL INCORRECT ANSWER

Exhibit MACRS StraightLine Depreciation for Personal Property Assuming

HalfYear Convention

Note: The last two rows of this table are used for qualified improvement property year normal MACRS; year

ADS

Exhibit Alternative Minimum Tax: DecliningBalance Assuming

HalfYear Convention Percentage Rates

The figures in this table are taken from the official table that appears in RevProc. CB

Because of its length, the complete table is not presented.

Switchover to straightline depreciation.

Exhibit ADS StraightLine for Personal Property Assuming HalfYear

Convention Percentage Rates

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock