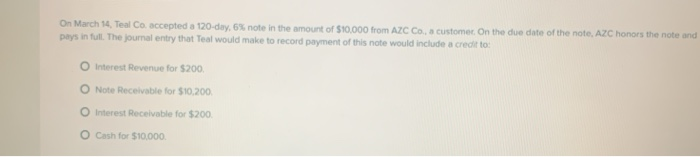

Question: On March 14, Teal Co. accepted a 120-day, 6% note in the amount of $10,000 from AZC Co., a customer. On the due date of

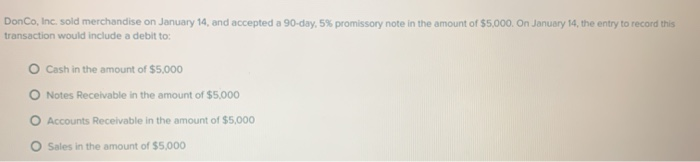

On March 14, Teal Co. accepted a 120-day, 6% note in the amount of $10,000 from AZC Co., a customer. On the due date of the note, AZC honors the note and pays in full. The journal entry that Teal would make to record payment of this note would include a credit to: Interest Revenue for $200 Note Receivable for $10.200. Interest Receivable for $200 O Cash for $10.000 DonCo, Inc. sold merchandise on January 14, and accepted a 90-day, 5% promissory note in the amount of $5,000. On January 14, the entry to record this transaction would include a debit to: Cash in the amount of $5,000 Notes Receivable in the amount of $5,000 Accounts Receivable in the amount of $5,000 Sales in the amount of $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts