Question: On March 2 , 2 0 2 2 , Saber Industries purchased robotic equipment to use in manufacturing 6 marks electric automobiles. The equipment is

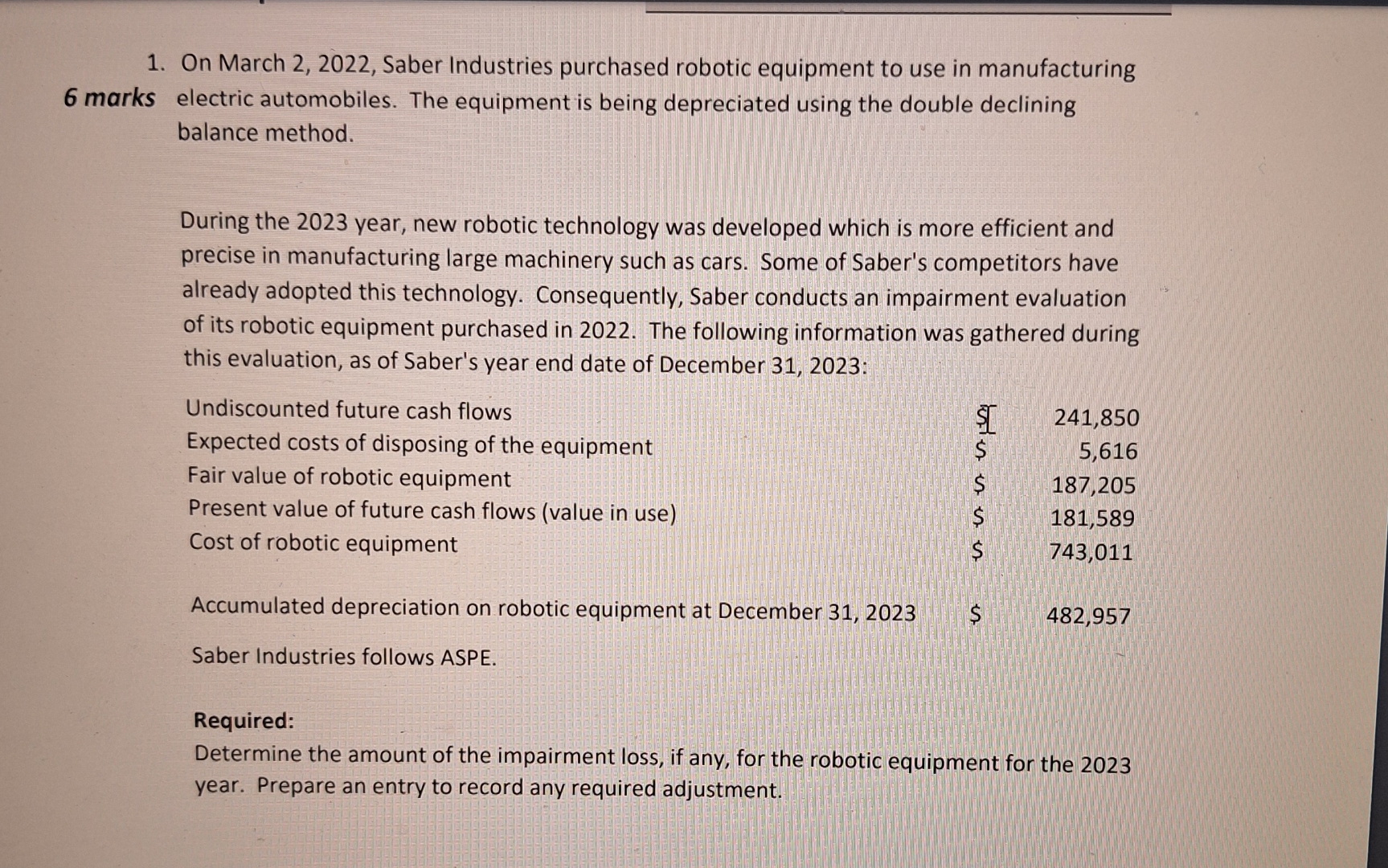

On March Saber Industries purchased robotic equipment to use in manufacturing marks electric automobiles. The equipment is being depreciated using the double declining balance method.

During the year, new robotic technology was developed which is more efficient and precise in manufacturing large machinery such as cars. Some of Saber's competitors have already adopted this technology. Consequently, Saber conducts an impairment evaluation of its robotic equipment purchased in The following information was gathered during this evaluation, as of Saber's year end date of December :

Undiscounted future cash flows

Expected costs of disposing of the equipment

Fair value of robotic equipment

Present value of future cash flows value in use

Cost of robotic equipment

table$$$$$$

Accumulated depreciation on robotic equipment at December

Saber Industries follows ASPE.

Required:

Determine the amount of the impairment loss, if any, for the robotic equipment for the year. Prepare an entry to record any required adjustment.

Can you also provide photo of you solution you did in paper,? thank You

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock