Question: On March 2 3 , a company declared a dividend of $ 2 . 0 0 per share to be paid on July 1 2

On March a company declared a dividend of $ per share to be paid on July to shareholders of record on June There are shares outstanding.

What is needed in the journal entry to record the payment of the dividends on July

Credit to cash for $

Credit to dividends for $

Credit to paidin capital in excess of par for $

Credit to dividends payable for $

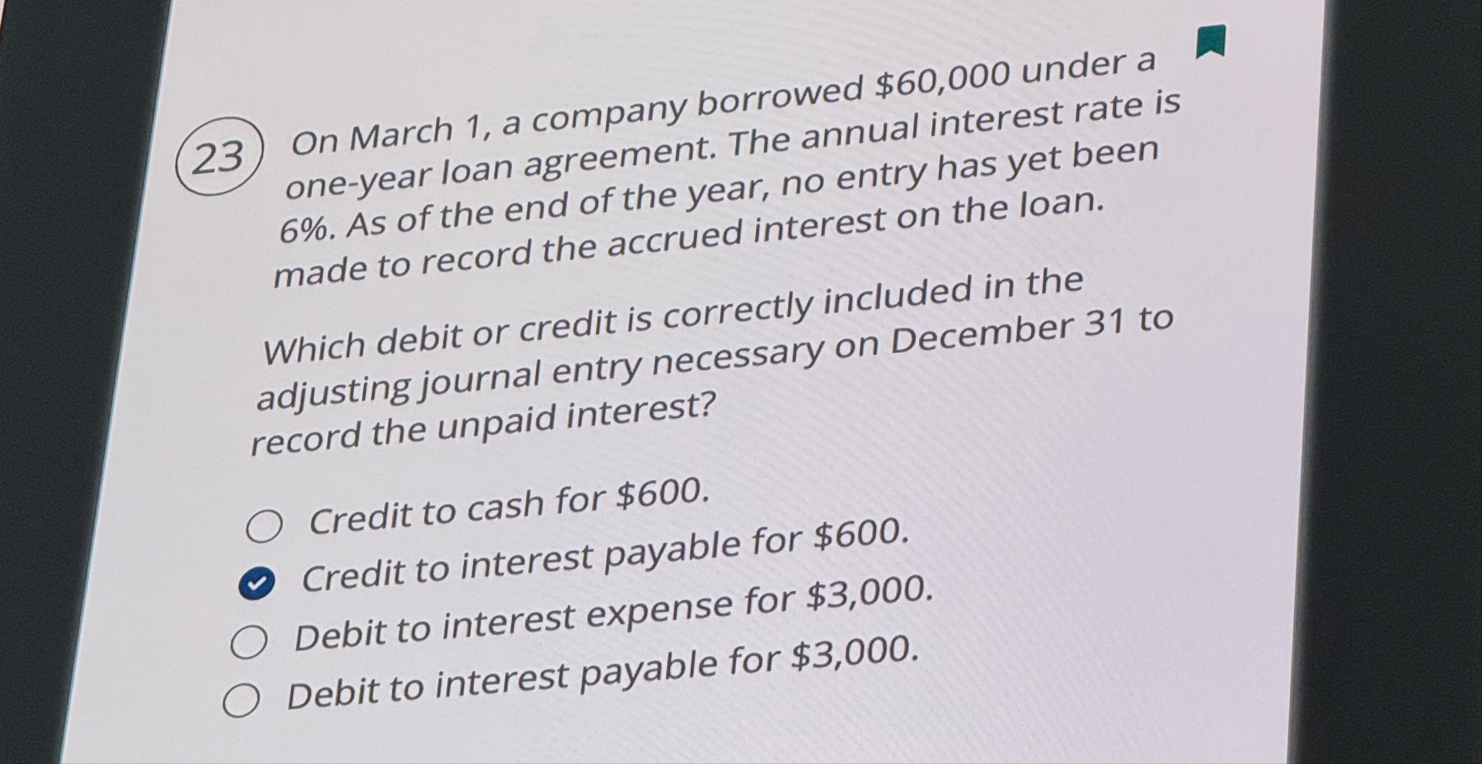

On March a company borrowed $ under a oneyear loan agreement. The annual interest rate is As of the end of the year, no entry has yet been made to record the accrued interest on the loan.

Which debit or credit is correctly included in the adjusting journal entry necessary on December to record the unpaid interest?

Credit to cash for $

Credit to interest payable for $

Debit to interest expense for $

Debit to interest payable for $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock