Question: On March 3 1 , 2 0 2 3 , Capital Investment Advisers paid $ 4 , 5 1 0 , 0 0 0 for

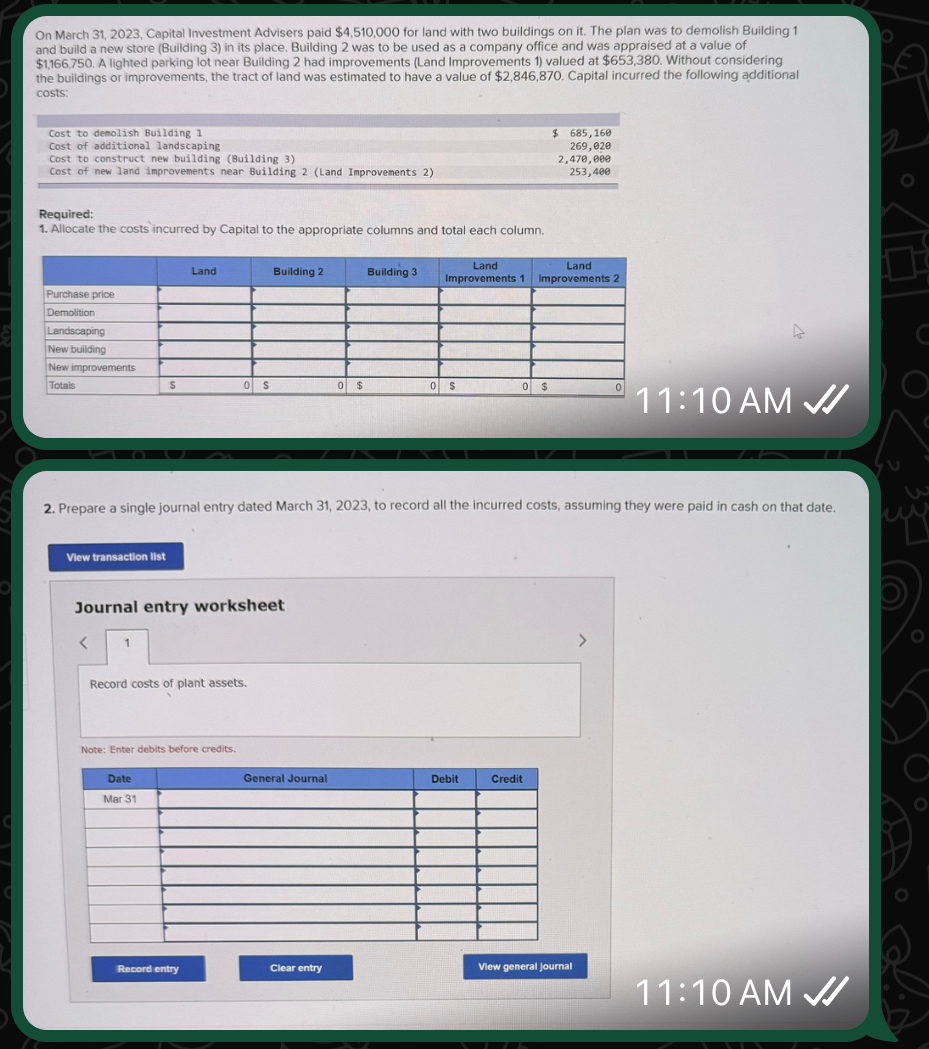

On March Capital Investment Advisers paid $ for land with two buildings on it The plan was to demolish Building and build a new store Building in its place. Building was to be used as a company office and was appraised at a value of $ A lighted parking lot near Building had improvements Land Improvements valued at $ Without considering the buildings or improvements, the tract of land was estimated to have a value of $ Capital incurred the following additional costs:

Cost to demolish Building

Cost of additional landscaping

Cost to construct new building Building

Cost of new land improvements near Building Land Improvements

$

Required:

Allocate the costs incurred by Capital to the appropriate columns and total each column.

tableLand,Building Building tableLandImprovements tableLandImprovements Purchase price,,,,,DemolitionLandscapingNew building,,,,,New improvements,,,,,Totals$

: AM

Prepare a single journal entry dated March to record all the incurred costs, assuming they were paid in cash on that date.

Journal entry worksheet

Record costs of plant assets.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditMar

: AM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock