Question: On March 31, 2019, GRANGER CORP. received a note receivable amounting to P5,000,000 in exchange for its delivery vehicle with a carrying amount of

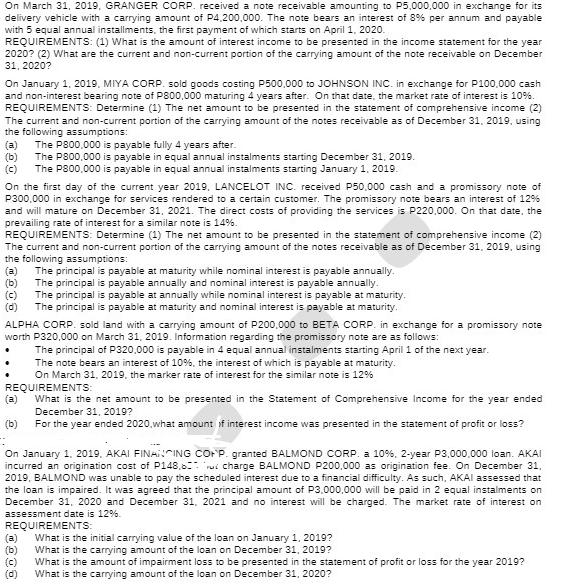

On March 31, 2019, GRANGER CORP. received a note receivable amounting to P5,000,000 in exchange for its delivery vehicle with a carrying amount of P4,200,000. The note bears an interest of 8% per annum and payable with 5 equal annual installments, the first payment of which starts on April 1, 2020. REQUIREMENTS: (1) What is the amount of interest income to be presented in the income statement for the year 2020? (2) What are the current and non-current portion of the carrying amount of the note receivable on December 31, 2020? On January 1, 2019, MIYA CORP. sold goods costing P500,000 to JOHNSON INC. in exchange for P100,000 cash and non-interest bearing note of P800,000 maturing 4 years after. On that date, the market rate of interest is 10%. REQUIREMENTS: Determine (1) The net amount to be presented in the statement of comprehensive income (2) The current and non-current portion of the carrying amount of the notes receivable as of December 31, 2019, using the following assumptions: (a) The P800,000 is payable fully 4 years after. (b) The P800,000 is payable in equal annual instalments starting December 31, 2019. (c) The P800,000 is payable in equal annual instalments starting January 1, 2019. On the first day of the current year 2019, LANCELOT INC. received P50,000 cash and a promissory note of P300,000 in exchange for services rendered to a certain customer. The promissory note bears an interest of 12% and will mature on December 31, 2021. The direct costs of providing the services is P220,000. On that date, the prevailing rate of interest for a similar note is 14%. REQUIREMENTS: Determine (1) The net amount to be presented in the statement of comprehensive income (2) The current and non-current portion of the carrying amount of the notes receivable as of December 31, 2019, using the following assumptions: (a) The principal is payable at maturity while nominal interest is payable annually. The principal is payable annually and nominal interest is payable annually. (b) The principal is payable at annually while nominal interest is payable at maturity. (d) The principal is payable at maturity and nominal interest is payable at maturity. ALPHA CORP. sold land with a carrying amount of P200,000 to BETA CORP. in exchange for a promissory note worth P320,000 on March 31, 2019. Information regarding the promissory note are as follows: . The principal of P320,000 is payable in 4 equal annual instalments starting April 1 of the next year. The note bears an interest of 10%, the interest of which is payable at maturity. On March 31, 2019, the marker rate of interest for the similar note is 12% REQUIREMENTS: What is the net amount to be presented in the Statement of Comprehensive Income for the year ended December 31, 2019? For the year ended 2020,what amount of interest income was presented in the statement of profit or loss? (a) (b) On January 1, 2019, AKAI FINANCING CORP. granted BALMOND CORP. a 10%, 2-year P3,000,000 loan. AKAI incurred an origination cost of P148,6 charge BALMOND P200,000 as origination fee. On December 31, 2019, BALMOND was unable to pay the scheduled interest due to a financial difficulty. As such, AKAI assessed that the loan is impaired. It was agreed that the principal amount of P3,000,000 will be paid in 2 equal instalments on December 31, 2020 and December 31, 2021 and no interest will be charged. The market rate of interest on assessment date is 12%. REQUIREMENTS: (a) What is the initial carrying value of the loan on January 1, 2019? (b) What is the carrying amount of the loan on December 31, 2019? (c) What is the amount of impairment loss to be presented in the statement of profit or loss for the year 2019? (d) What is the carrying amount of the loan on December 31, 2020?

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Answer GRANGER CORP a Interest income for 2020 The interest rate is 8 and the note receivable is P5000000 Since the first payment starts on April 1 20... View full answer

Get step-by-step solutions from verified subject matter experts