Question: On March 31, 2023, Collins Incorporated issued a long-term note to Jenkins Federal Bank. The $500,000 note does not pay coupon payments but the

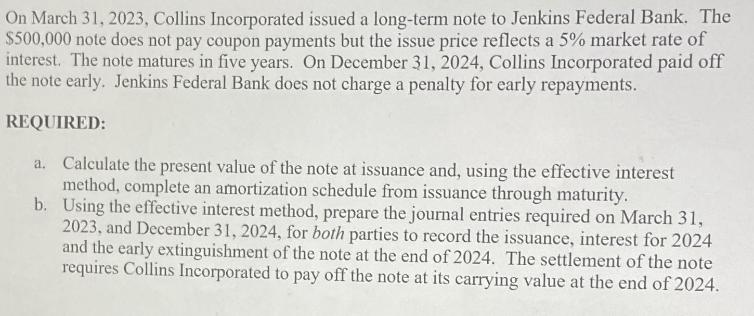

On March 31, 2023, Collins Incorporated issued a long-term note to Jenkins Federal Bank. The $500,000 note does not pay coupon payments but the issue price reflects a 5% market rate of interest. The note matures in five years. On December 31, 2024, Collins Incorporated paid off the note early. Jenkins Federal Bank does not charge a penalty for early repayments. REQUIRED: a. Calculate the present value of the note at issuance and, using the effective interest method, complete an amortization schedule from issuance through maturity. b. Using the effective interest method, prepare the journal entries required on March 31, 2023, and December 31, 2024, for both parties to record the issuance, interest for 2024 and the early extinguishment of the note at the end of 2024. The settlement of the note requires Collins Incorporated to pay off the note at its carrying value at the end of 2024.

Step by Step Solution

There are 3 Steps involved in it

The image youve provided contains a question related to accounting and finance It describes a scenario where Collins Incorporated issues a longterm note with certain conditions and asks for several ca... View full answer

Get step-by-step solutions from verified subject matter experts