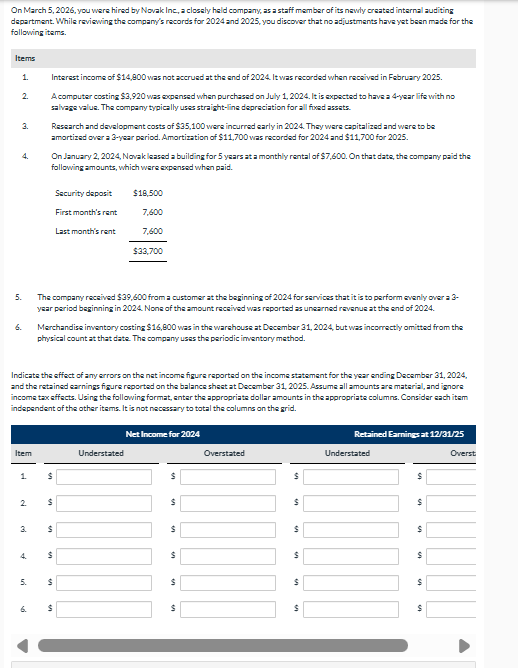

Question: On March 5 , 2 0 2 6 , you were hired by Novak Inc, a closely hald company, as a staff member of its

On March you were hired by Novak Inc, a closely hald company, as a staff member of its navily created internal auditing departmant. While reviewing the company's records for and you discover that no adjustmants hava yet baen made for the following items. Items Interest income of $ was nat accruad at the and of It was recorded when received in February Acomputer coating $ was expensed when purchased on July It is expacted to havea year life with no salvage value. The company typically uses straightline depraciation for all foxed assets. Research and devalopment costs of $ were incurred early in They ware capitalized and ware to be amortized over a year period. Amortization of $ was racordad for and $ for On January Novak lasesd a building for yars at a monthly rental of $ On that date, the company paid the following amounts, which ware expensed when paid. The company received $ from a customer at the baginning of for services that it is to perform evenly over a yaar period baginning in None of the amount raceived was raported as unearned revenue at the end of Merchandise imentory costing $ was in the warahouse at December but was incorrectly omitted from the physical count at that date. The company uses the periodic inventory method. Indicate the effect of any errors on the net income figure reported on the income statement for the year ending December and the retained earnings fagure reported on the balance shest at December Assume all amounts are material, and ignore income tax effacts. Using the following format, enter the appropriate dollar amounts in the appropriate columns. Considar aach itam independent of the other items. It is not necessary to tatal the calumns on the grid.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock