Question: On May 1 , 2 0 2 3 , a company purchased a car to be used by the Sales Department. The car cost

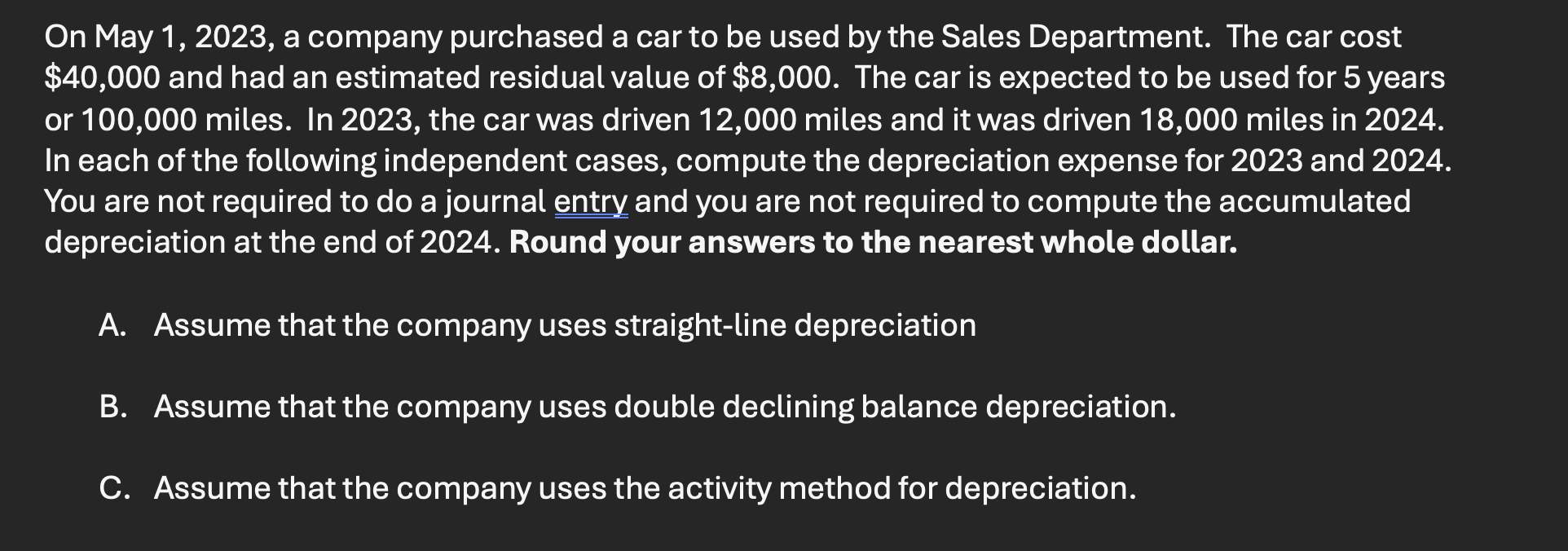

On May a company purchased a car to be used by the Sales Department. The car cost $ and had an estimated residual value of $ The car is expected to be used for years or miles. In the car was driven miles and it was driven miles in In each of the following independent cases, compute the depreciation expense for and You are not required to do a journal entry and you are not required to compute the accumulated depreciation at the end of Round your answers to the nearest whole dollar.

A Assume that the company uses straightline depreciation

B Assume that the company uses double declining balance depreciation.

C Assume that the company uses the activity method for depreciation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock