Question: On May 1 , 2 0 2 5 , Cullumber Corporation purchased $ 1 , 6 3 0 , 0 0 0 of 1 2

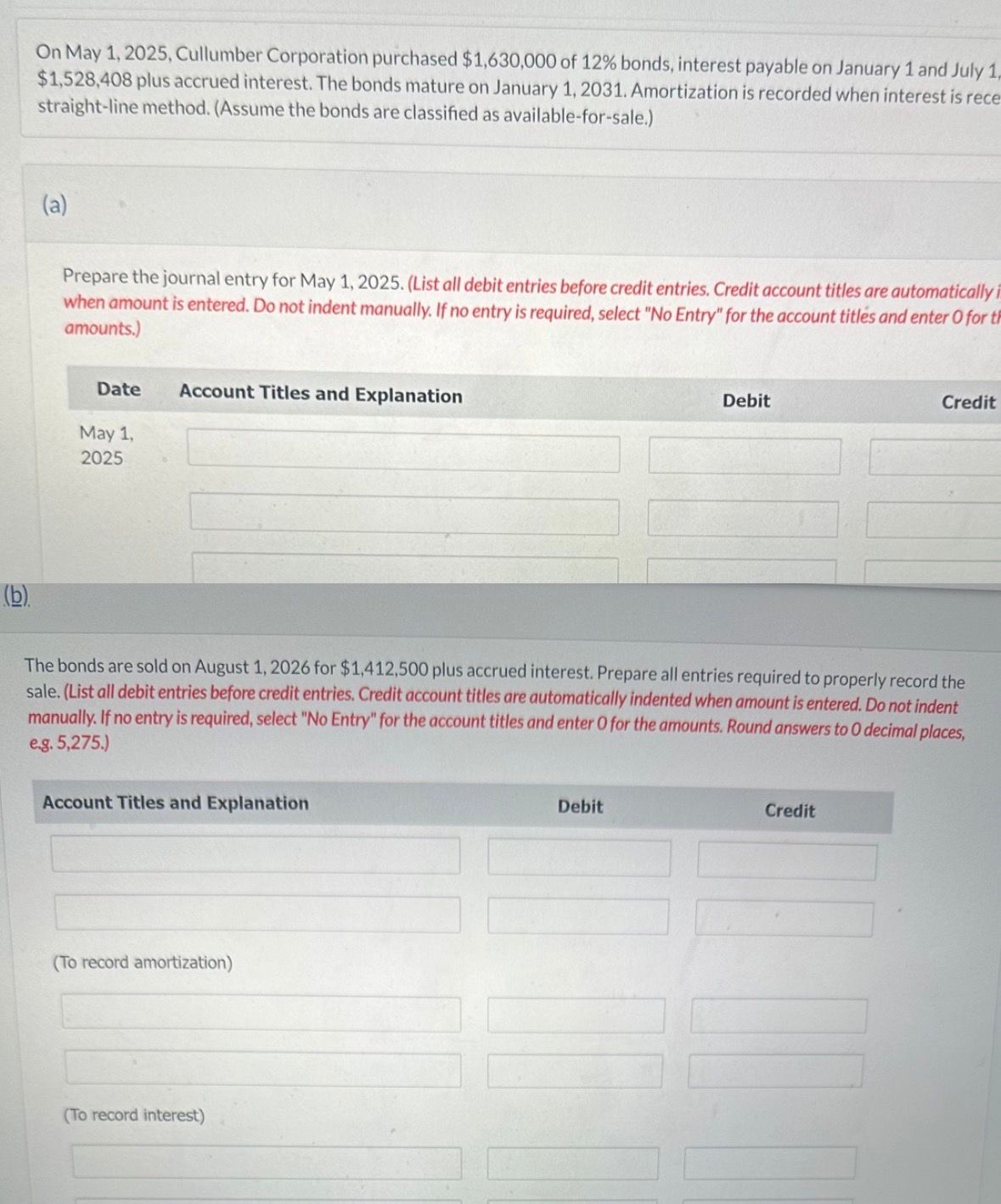

On May Cullumber Corporation purchased $ of bonds, interest payable on January and July $ plus accrued interest. The bonds mature on January Amortization is recorded when interest is rece straightline method. Assume the bonds are classified as availableforsale.

a

Prepare the journal entry for May List all debit entries before credit entries. Credit account titles are automatically i when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for t amounts.

Date Account Titles and Explanation

May

b

The bonds are sold on August for $ plus accrued interest. Prepare all entries required to properly record the sale. List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. Round answers to decimal places, eg

Account Titles and Explanation

Debit

Credit

To record amortization

To record interest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock