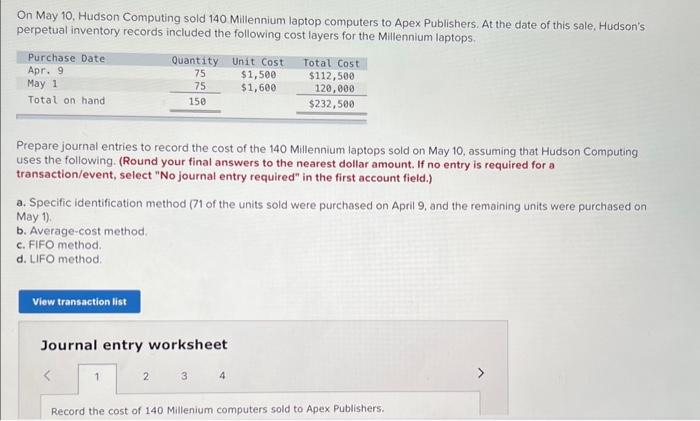

Question: On May 10. Hudson Computing sold 140 Millennium laptop computers to Apex Publishers. At the date of this sale, Hudson's perpetual inventory records included the

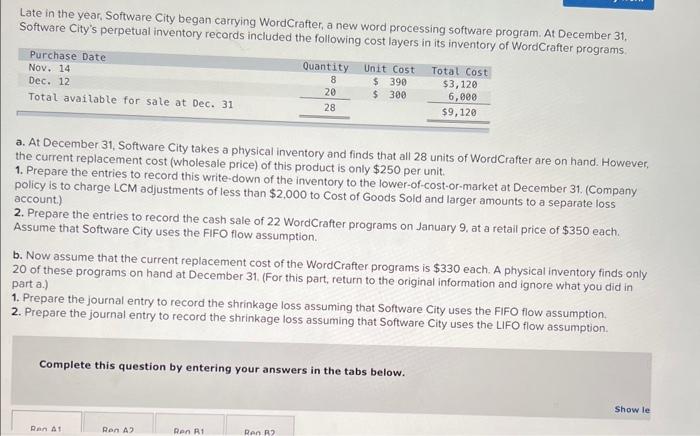

On May 10. Hudson Computing sold 140 Millennium laptop computers to Apex Publishers. At the date of this sale, Hudson's perpetual inventory records included the following cost layers for the Millennium laptops. Prepare journal entries to record the cost of the 140 Millennium laptops sold on May 10, assuming that Hudson Computing uses the following. (Round your final answers to the nearest dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Specific identification method (71 of the units sold were purchased on April 9, and the remaining units were purchased on May 1). b. Average-cost method. c. FIFO method. d. LIFO method: Late in the year, Software City began carrying WordCrafter, a new word processing software program. At December 31 , Software City's perpetual inventory records included the following cost lavers in itc inwantan. of WordCrafter programs. a. At December 31, Software City takes a physical inventory and finds that all 28 units of WordCrafter are on hand. However. the current replacement cost (wholesale price) of this product is only $250 per unit. 1. Prepare the entries to record this write-down of the inventory to the lower-of-cost-or-market at December 31 . (Company policy is to charge LCM adjustments of less than $2,000 to Cost of Goods Sold and larger amounts to a separate loss account.) 2. Prepare the entries to record the cash sale of 22 WordCrafter programs on January 9 , at a retail price of $350 each. Assume that Software City uses the FIFO flow assumption. b. Now assume that the current replacement cost of the WordCrafter programs is $330 each. A physical inventory finds only 20 of these programs on hand at December 31. (For this part, return to the original information and ignore what you did in part a.) 1. Prepare the journal entry to record the shrinkage loss assuming that Software City uses the FIFO flow assumption. 2. Prepare the journal entry to record the shrinkage loss assuming that Software City uses the LIFO flow assumption. Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts