Question: On November 1 , 2 0 2 2 , Crane Corporation management decided to discontinue operation of its Rocketeer Division and approved a formal plan

On November Crane Corporation management decided to discontinue operation of its Rocketeer Division and approved a

formal plan to dispose of the division. Crane is a successful corporation with earnings of $ million or more before tax for each

of the past five years. The Rocketeer Division, a major part of Crane's operations, is being discontinued because it has not contributed

to this profitable performance.

The division's main assets are the land, building, and equipment used to manufacture engine components. The land, building, and

equipment had a net book value of $ million on November

Crane's management has entered into negotiations for a cash sale of the division for $ million net of costs to sell The sale date

and final disposal date of the division is expected to be July Crane has a fiscal year ending May The results of operations

for the Rocketeer Division for the fiscal year and the estimated results for June are presented below. The before

tax losses after October are calculated without depreciation on the building and equipment.

The Rocketeer Division will be accounted for as a discontinued operation on Crane's financial statements for the year ended May

Crane's tax rate is on operating income and all gains and losses. Crane prepares financial statements in accordance with

IFRS.

b

Your answer is correct.

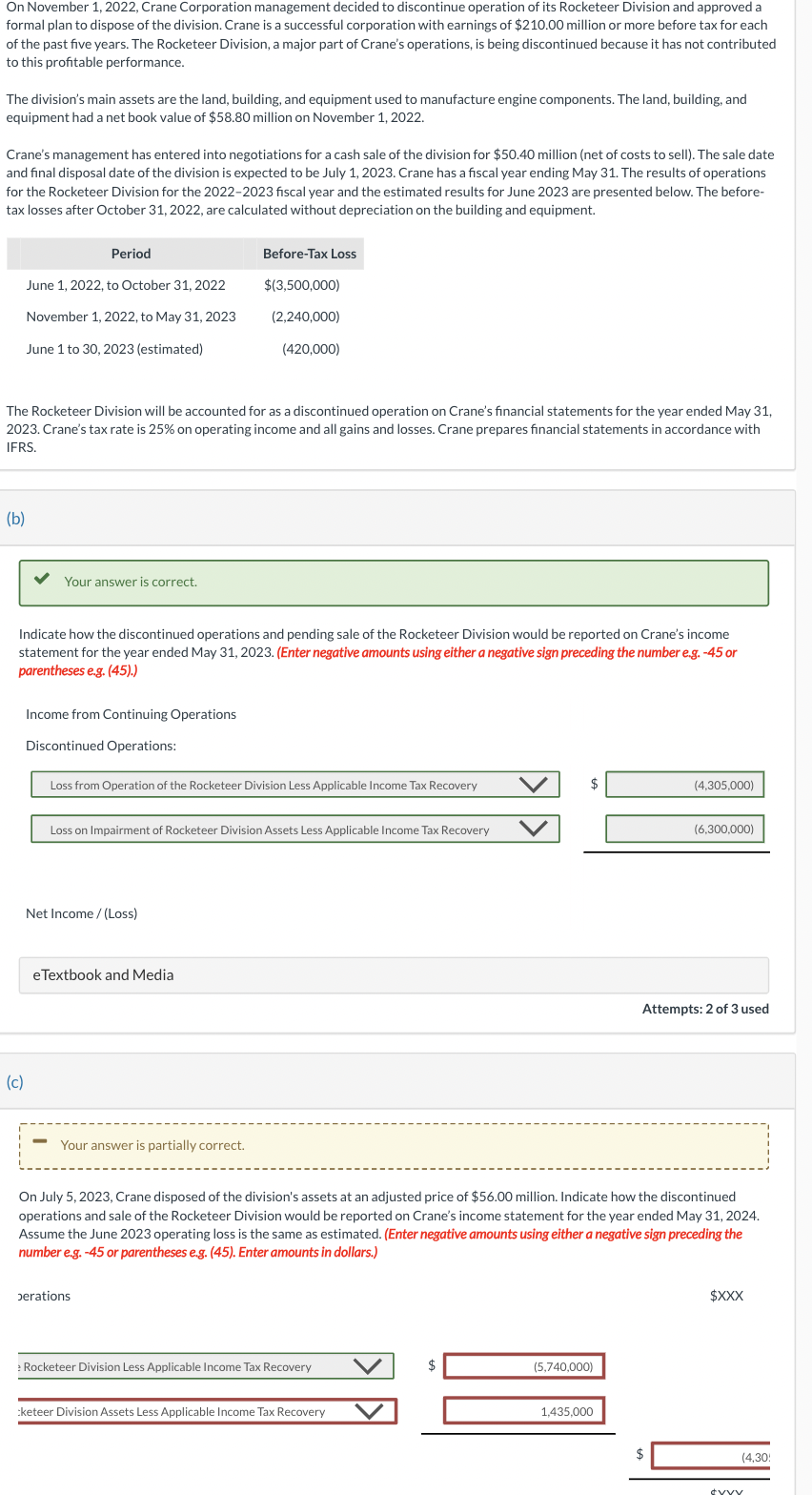

Indicate how the discontinued operations and pending sale of the Rocketeer Division would be reported on Crane's income

statement for the year ended May Enter negative amounts using either a negative sign preceding the number eg or

parentheses eg

Income from Continuing Operations

Discontinued Operations:

Loss from Operation of the Rocketeer Division Less Applicable Income Tax Recovery

$

Loss on Impairment of Rocketeer Division Assets Less Applicable Income Tax Recovery

Net Income Loss

eTextbook and Media

Attempts: of used

c

Your answer is partially correct.

On July Crane disposed of the division's assets at an adjusted price of $ million. Indicate how the discontinued

operations and sale of the Rocketeer Division would be reported on Crane's income statement for the year ended May

Assume the June operating loss is the same as estimated. Enter negative amounts using either a negative sign preceding the

number eg or parentheses eg Enter amounts in dollars.

Jerations

$XXX

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock