Question: On November 30, 2018, Tucker Products performed computer programming services for Damascus Inc. in exchange for a five- month, $75,000, 10% note receivable. Damascus Inc.

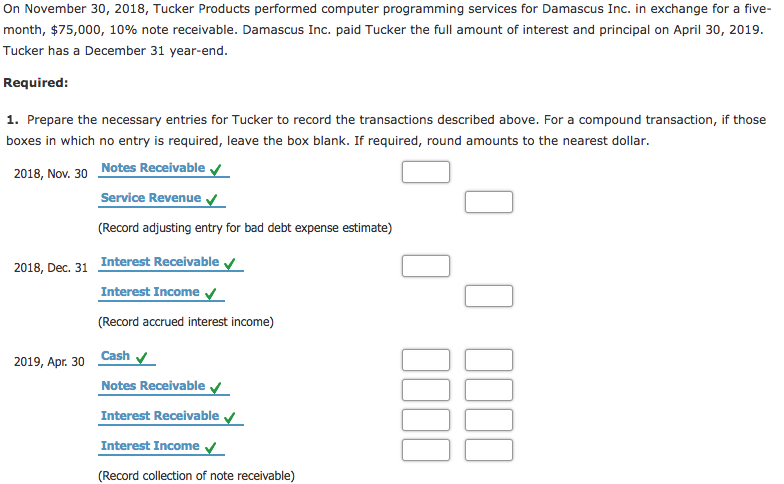

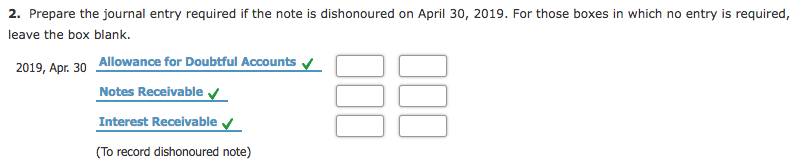

On November 30, 2018, Tucker Products performed computer programming services for Damascus Inc. in exchange for a five- month, $75,000, 10% note receivable. Damascus Inc. paid Tucker the full amount of interest and principal on April 30, 2019. Tucker has a December 31 year-end. Required: 1. Prepare the necessary entries for Tucker to record the transactions described above. For a compound transaction, if those boxes in which no entry is required, leave the box blank. If required, round amounts to the nearest dollar. 2018, Nov. 30 Notes Receivable Service Revenue Record adjusting entry for bad debt expense estimate) 2018, Dec. 31 Interest Receivable Interest Income (Record accrued interest income) 2019, Apr. 30 Cash Notes Receivable Interest Receivable V Interest Income (Record collection of note receivable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts