Question: On November 8 , 2 0 2 4 , Power Corp. sold land to Wood Co . , its wholly owned subsidiary. The land cost

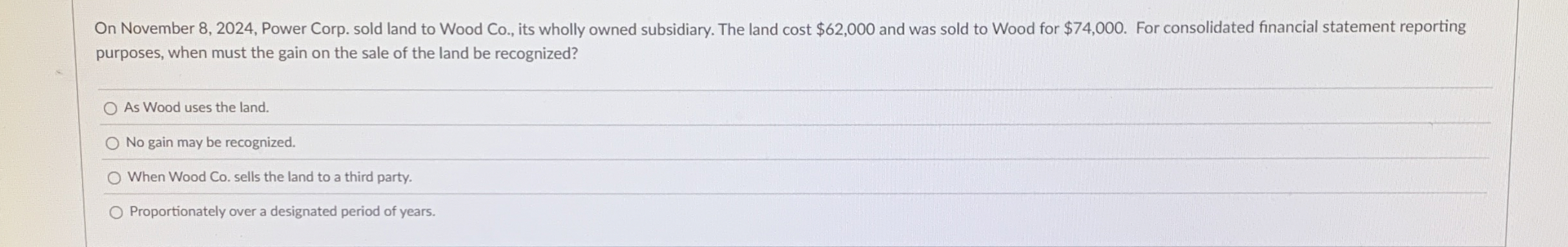

On November Power Corp. sold land to Wood Co its wholly owned subsidiary. The land cost $ and was sold to Wood for $ For consolidated financial statement reporting purposes, when must the gain on the sale of the land be recognized?

As Wood uses the land.

No gain may be recognized.

When Wood Co sells the land to a third party.

Proportionately over a designated period of years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock