Question: On Oct. 1 , 2 0 2 1 , the beginning of the 4 th quarter, Sooner Co . held $ 5 0 million of

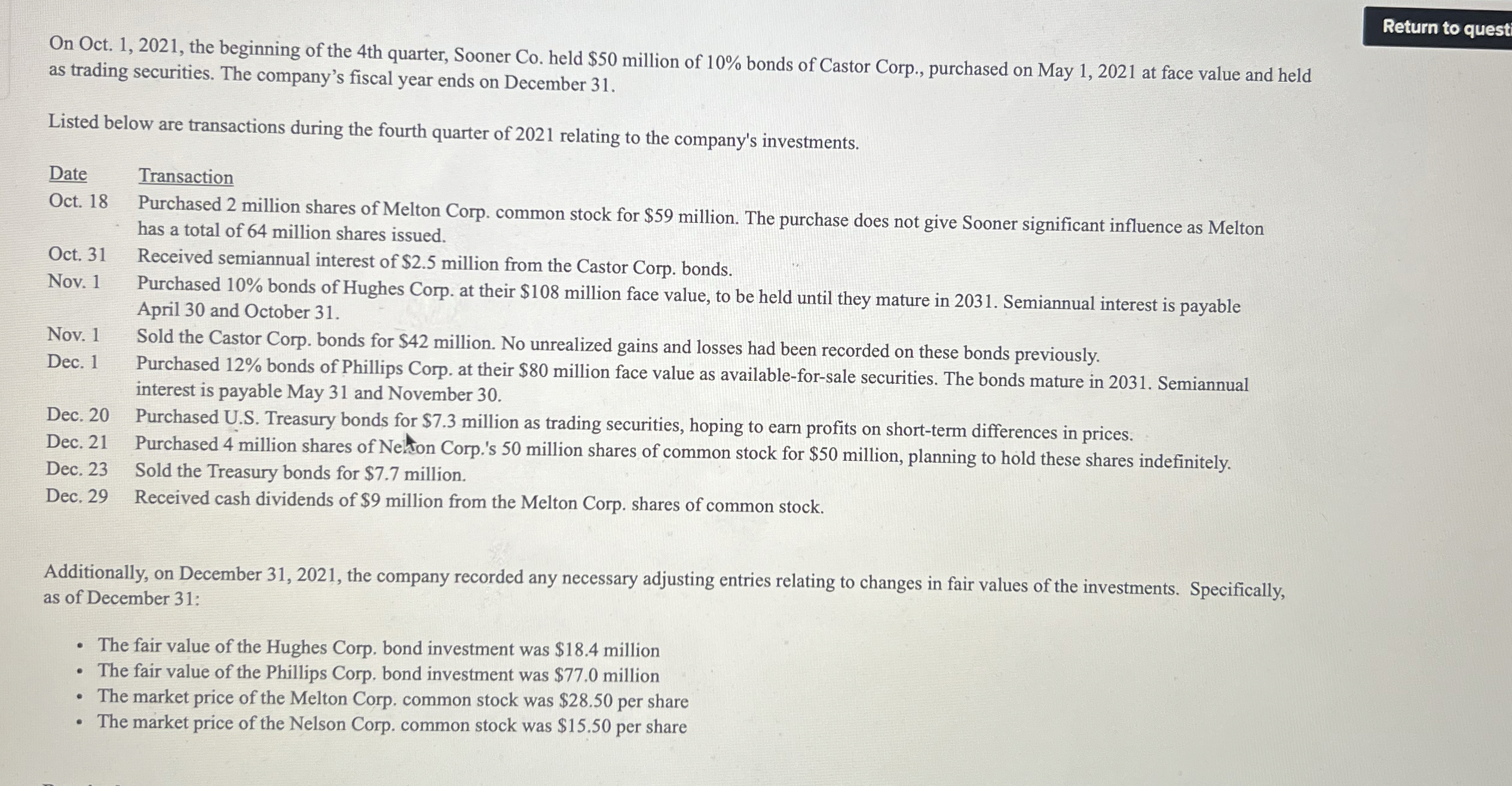

On Oct. the beginning of the th quarter, Sooner Co held $ million of bonds of Castor Corp., purchased on May at face value and held as trading securities The company's fiscal year ends on December

Listed below are transactions during the fourth quarter of relating to the company's investments.

Date Transaction

Oct. Purchased million shares of Melton Corp. common stock for $ million. The purchase does not give Sooner significant influence as Melton has a total of million shares issued.

Oct. Received semiannual interest of $ million from the Castor Corp. bonds.

Nov. Purchased bonds of Hughes Corp. at their $ million face value, to be held until they mature in Semiannual interest is payable April and October

Nov. Sold the Castor Corp. bonds for $ million. No unrealized gains and losses had been recorded on these bonds previously.

Dec. Purchased bonds of Phillips Corp. at their $ million face value as availableforsale securities The bonds mature in Semiannual interest is payable May and November

Dec. Purchased US Treasury bonds for $ million as trading securities hoping to earn profits on shortterm differences in prices.

Dec. Purchased million shares of Nelton Corp.s million shares of common stock for $ million, planning to hold these shares indefinitely.

Dec. Sold the Treasury bonds for $ million.

Dec. Received cash dividends of $ million from the Melton Corp. shares of common stock.

Additionally, on December the company recorded any necessary adjusting entries relating to changes in fair values of the investments. Specifically, as of December :

The fair value of the Hughes Corp. bond investment was $ million

The fair value of the Phillips Corp. bond investment was $ million

The market price of the Melton Corp. common stock was $ per share

The market price of the Nelson Corp. common stock was $ per share. Please provide the balance sheet and income stmt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock