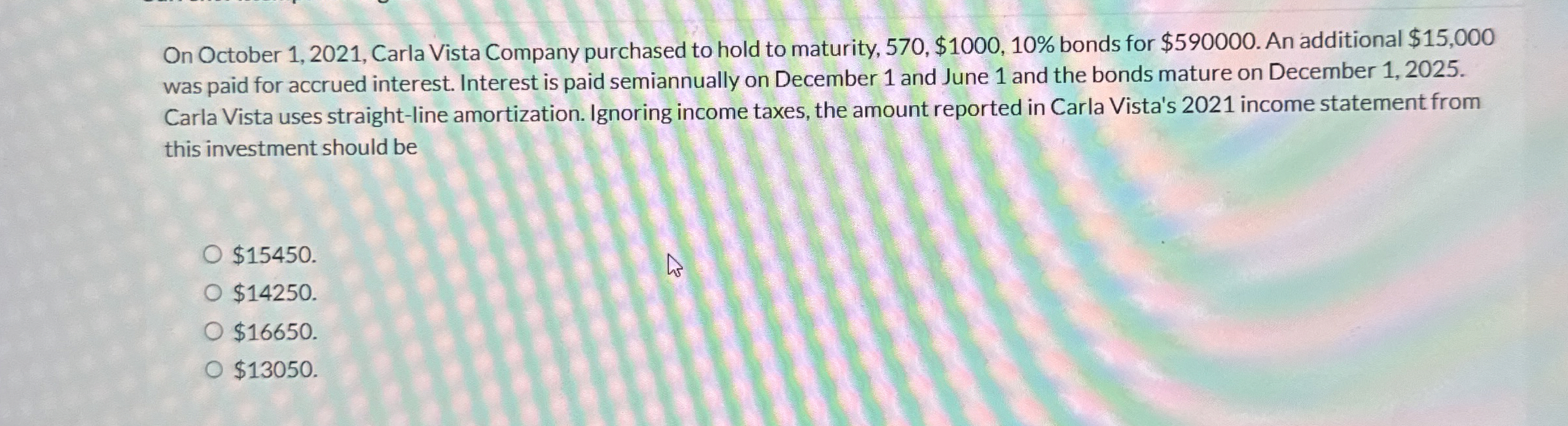

Question: On October 1 , 2 0 2 1 , Carla Vista Company purchased to hold to maturity, 5 7 0 , $ 1 0 0

On October Carla Vista Company purchased to hold to maturity, $ bonds for $ An additional $ was paid for accrued interest. Interest is paid semiannually on December and June and the bonds mature on December Carla Vista uses straightline amortization. Ignoring income taxes, the amount reported in Carla Vista's income statement from this investment should be

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock