Question: On October 1 , 2 0 2 4 , Ryan acquired some land for ( $ 3 0 0 , 0 0 0

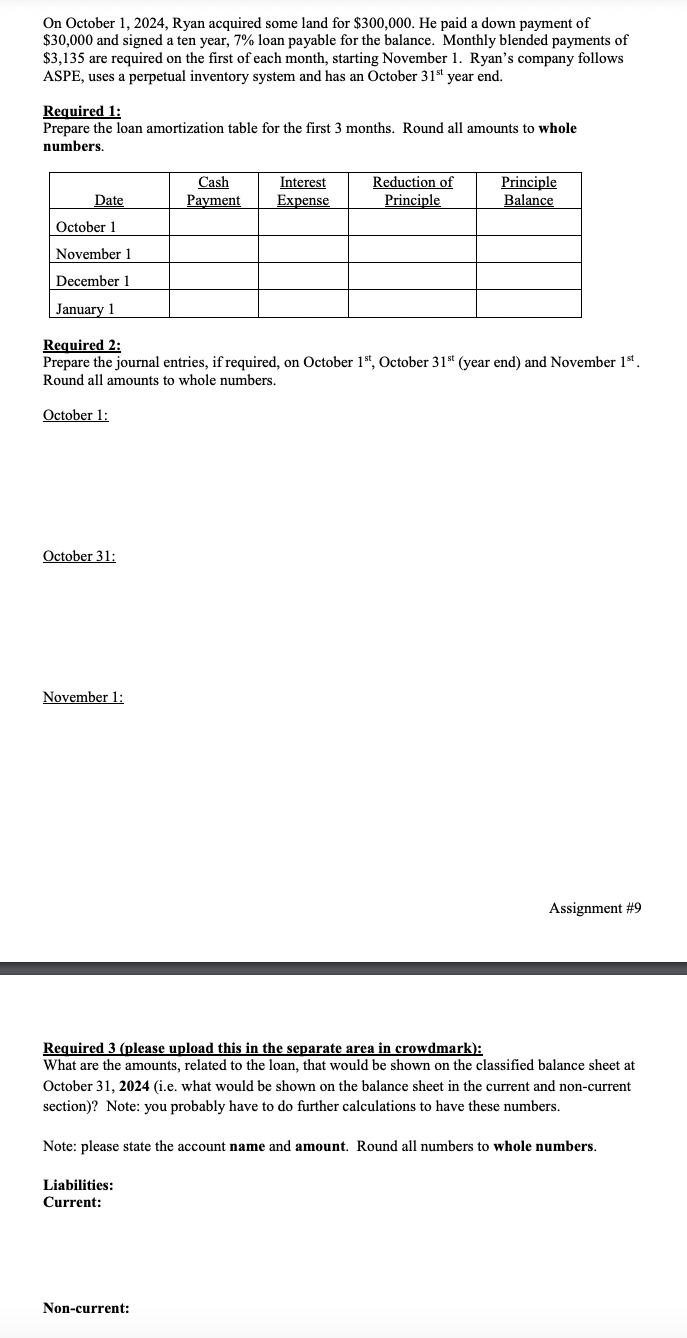

On October Ryan acquired some land for $ He paid a down payment of $ and signed a ten year, loan payable for the balance. Monthly blended payments of $ are required on the first of each month, starting November Ryan's company follows ASPE, uses a perpetual inventory system and has an October text st year end.

Required :

Prepare the loan amortization table for the first months. Round all amounts to whole numbers.

Required :

Prepare the journal entries, if required, on October text st October text st year end and November text st Round all amounts to whole numbers.

October :

October :

November :

Required please upload this in the separate area in crowdmark:

What are the amounts, related to the loan, that would be shown on the classified balance sheet at October ie what would be shown on the balance sheet in the current and noncurrent section Note: you probably have to do further calculations to have these numbers.

Note: please state the account name and amount. Round all numbers to whole numbers.

Liabilities:

Current:

Noncurrent:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock