On October 1, 2020, Berlin Corp. purchased 250, $ 1,000, 9% bonds for $ 260,000. An...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

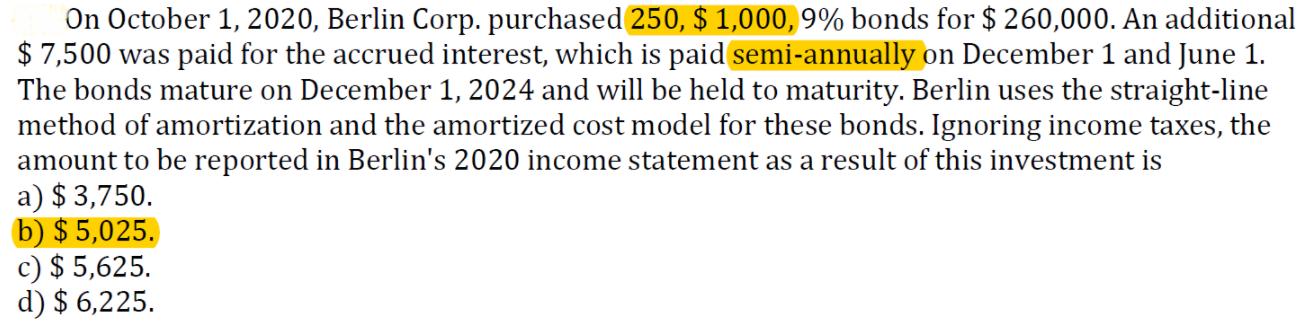

On October 1, 2020, Berlin Corp. purchased 250, $ 1,000, 9% bonds for $ 260,000. An additional $ 7,500 was paid for the accrued interest, which is paid semi-annually on December 1 and June 1. The bonds mature on December 1, 2024 and will be held to maturity. Berlin uses the straight-line method of amortization and the amortized cost model for these bonds. Ignoring income taxes, the amount to be reported in Berlin's 2020 income statement as a result of this investment is a) $ 3,750. b) $ 5,025. c) $ 5,625. d) $ 6,225. On October 1, 2020, Berlin Corp. purchased 250, $ 1,000, 9% bonds for $ 260,000. An additional $ 7,500 was paid for the accrued interest, which is paid semi-annually on December 1 and June 1. The bonds mature on December 1, 2024 and will be held to maturity. Berlin uses the straight-line method of amortization and the amortized cost model for these bonds. Ignoring income taxes, the amount to be reported in Berlin's 2020 income statement as a result of this investment is a) $ 3,750. b) $ 5,025. c) $ 5,625. d) $ 6,225.

Expert Answer:

Related Book For

Accounting Principles

ISBN: 978-1119048473

7th Canadian Edition Volume 2

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Posted Date:

Students also viewed these finance questions

-

Suppose you have a portfolio equally invested in four stocks. Each stock's expected return, standard deviations, and beta are in the following table. What is your portfolio's beta? LO4 Expected...

-

From the following details find out the correct amount of trade debtors. Debtors a/c appeared in the books of A/c Rs. 69,985. Includes the following (1) Rs. 6, 500 due from an employee on account of...

-

What possible treatment of choice could be used in dealing with Schistosoma japonicum and Fasciola hepatica infestation? And what is the effect of these treatments on these parasitic nematodes?

-

In Exercises 1 through 18, differentiate the given function. y 2+1 1-2

-

What is a balanced growth path?

-

A record turntable is rotating at 33 1/3 rev/min. A watermelon seed is on the turntable 6.0 cm from the axis of rotation. (a) Calculate the acceleration of the seed, assuming that it does not slip....

-

The cash flows associated with a project are shown below. The interest rate varies from year to year as shown. Determine an equivalent uniform annual series of cash flows. EOY Cash Flow Interest...

-

The comparative condensed balance sheets of Garcia Corporation are presented below. Instructions (a) Prepare a horizontal analysis of the balance sheet data for Garcia Corporation using 2013 as a...

-

5. Suppose that acts on density operators for Q with Kraus representation () - k=1 Let U M, (C), and define operators = 1, k BkUkjAj. , Show that B,..., B., are also Kraus operators for E. 6. Even...

-

Kendrick Anderson Furniture Maker, LLC creates custom tables in Atlanta. Assume that the following represents monthly information on production volume and manufacturing costs since the company...

-

The armature resistance and armature reactance of a 2.5MVA, 10kV, Y- connected, 8 pole Synchronous Motor respectively are 50/phase and 150/phase. Determine the excitation voltage, power input, power...

-

Briefly describe the following concepts: emission credits, the grandfathering principle, the emissions bubble policy, the emissions offsets policy, the emissions banking policy, pollution havens,...

-

Provide four reasons why economists generally dont favor a policy that is based on a command-and-control approach to environmental regulation.

-

Read the following statements. In response, state True, False or Uncertain and explain why: (a) Public intervention is both a necessary and sufficient condition for internalizing environmental...

-

Environmental regulation creates more jobs that it destroys. Do you agree? Discuss.

-

Quickly review the following concepts: the polluter-pays principle, regulatory capture, emission standards, effluent charge, and the double-dividend feature of pollution tax.

-

GV, formerly Google Ventures, is the venture capital investment arm of Alphabet Inc. The firm operates independently from Google and makes financially driven investment decisions. GV seeks to invest...

-

Outline some of the major problems confronting an international advertiser.

-

Selected comparative financial data (in thousands, except for share price) for Cineplex Inc. are shown below. Instructions (a) Calculate the following ratios for 2014: 1. Asset turnover 2. Current...

-

The condensed balance sheet of Laporte Corporation reports the following: The market price of the common shares is currently $30 per share. Laporte wants to assess the impact of three possible...

-

Leo Legal Services enters into a written contract to provide one month of legal service to J & J Home Inspections. Leo tells J & J that he can do the work required for a fee of $5,000. At the end of...

-

W hat is diauxic growth? Explain the roles of cAMP and CAP in this process.

-

What is antisense RNA? How does it affect the translation of a complementary mRNA?

-

List and describe three general ways that the functions of transcription factors can be modulated.

Study smarter with the SolutionInn App