Question: On October 2 2 nd , 2 0 1 8 , Dealer A purchased $ 1 million face amount of a 7 . 2 5

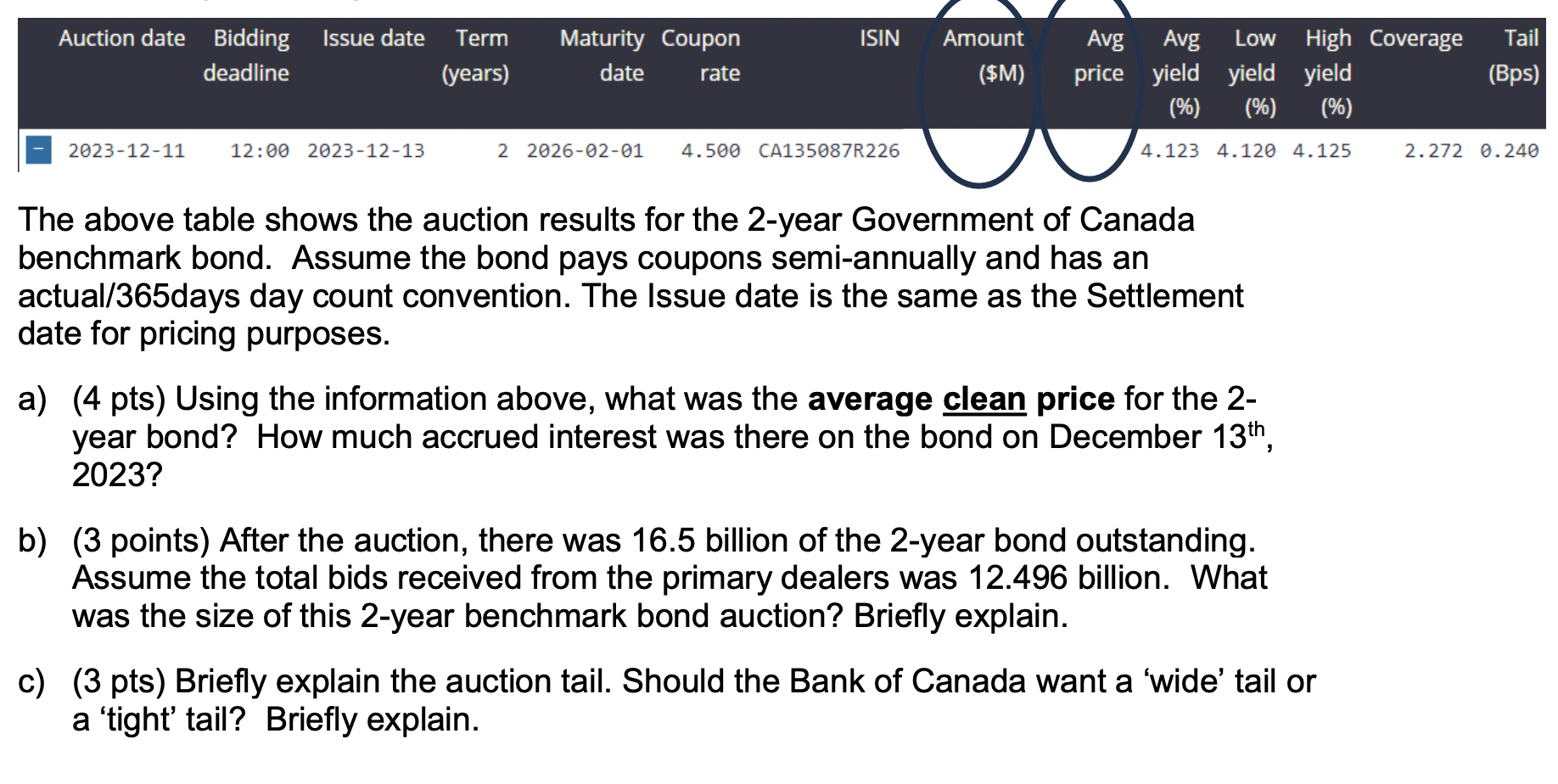

On October nd Dealer A purchased $ million face amount of a May Government of Canada bond. Assume that October nd is the settlement date for the bond purchase and the day count convention is actual days.The above table shows the auction results for the year Government of Canada

benchmark bond. Assume the bond pays coupons semiannually and has an

actualdays day count convention. The Issue date is the same as the Settlement

date for pricing purposes.

a pts Using the information above, what was the average clean price for the

year bond? How much accrued interest was there on the bond on December

b points After the auction, there was billion of the year bond outstanding.

Assume the total bids received from the primary dealers was billion. What

was the size of this year benchmark bond auction? Briefly explain.

c pts Briefly explain the auction tail. Should the Bank of Canada want a 'wide' tail or

a 'tight' tail? Briefly explain.nb

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock