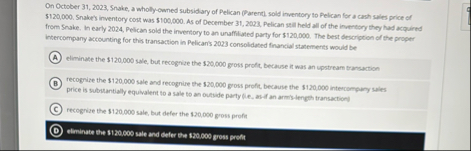

Question: On October 3 1 , 2 0 2 3 , Snake, a wholly - owned subsidary of Pelican ( Parencl . sold inventory to Pelican

On October Snake, a whollyowned subsidary of Pelican Parencl sold inventory to Pelican for a cash salies price of $ Snabe's inventory cost was $ As of December Petican gnt held all of the invertary they had acquired from Snake, in early Pelican sold the invertory to an unaffilated party for $ The best description of the proper intercompany accounting for this transaction in Pelican's consoldated financial statements would be

eliminate the $ sale, but recognize the $ gross profic, because it was an upstream transaction

recognize the $ sale and recognive the $ fross preft, because the $ intercompany luies price is sutriantially equivalent to a sale to an outwide party fe asif an armis lengh transaction

recognize the $ sale, but defer the gross profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock